Withholding Tax Malaysia 2018

5 december 2018 page 1 of 39 1.

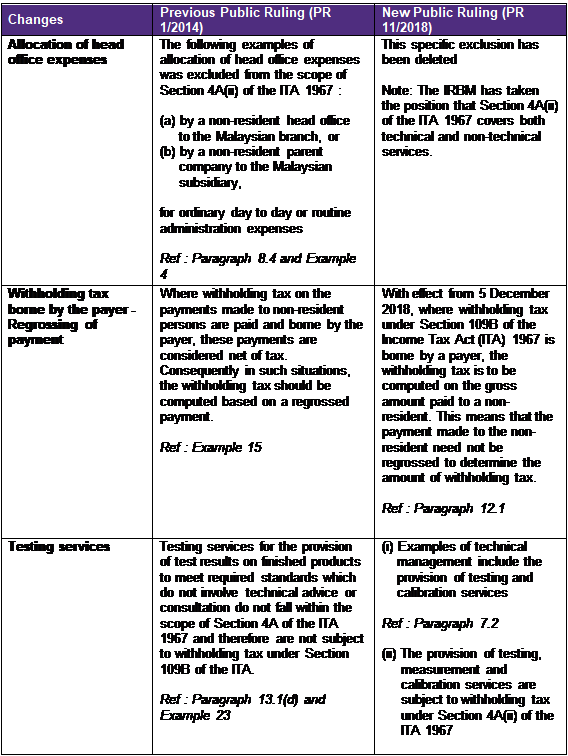

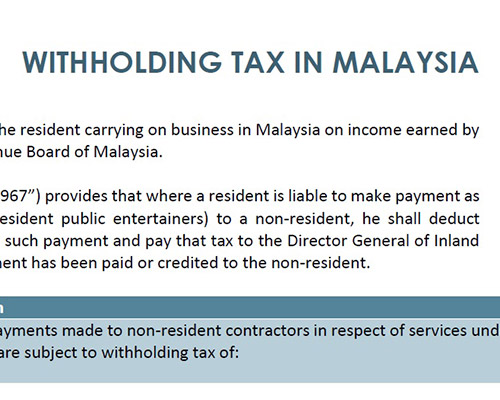

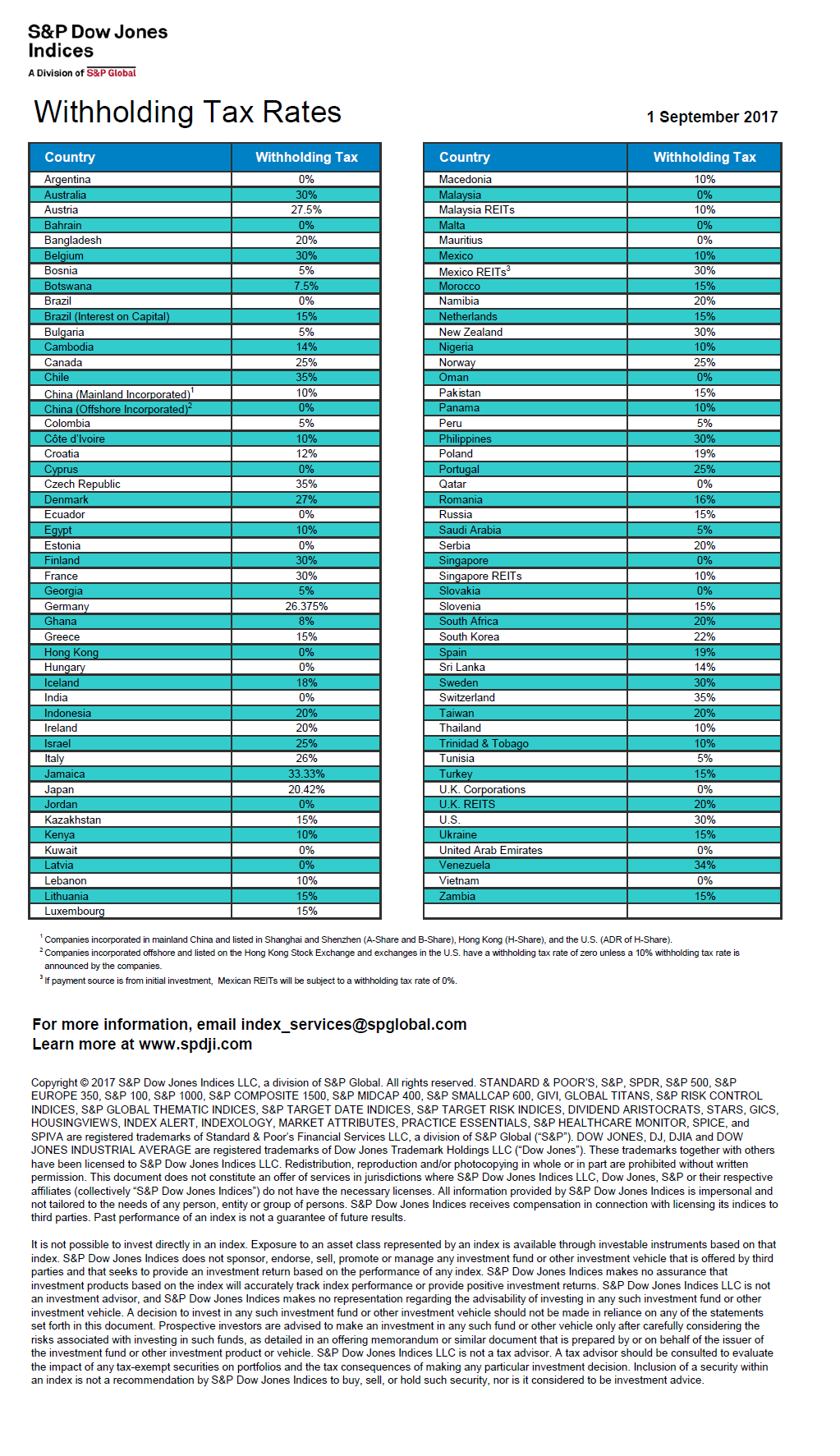

Withholding tax malaysia 2018. Withholding tax on special classes of income public ruling no 11 2018 inland revenue board of malaysia date of publication. Withholding tax is an amount withheld by the party making payment payer on income earned by a non resident payee and paid to the inland revenue board of malaysia. The prevailing wht rate is 10 except where a lower rate is provided in an applicable tax treaty. Introduction what is withholding tax.

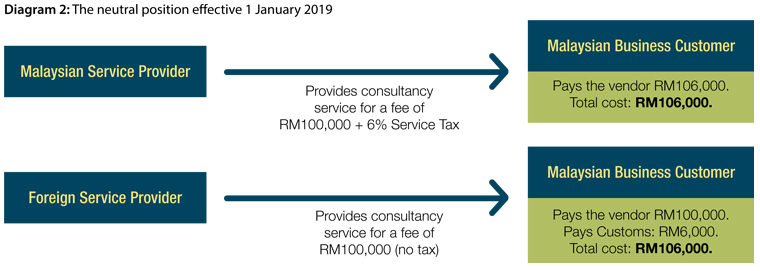

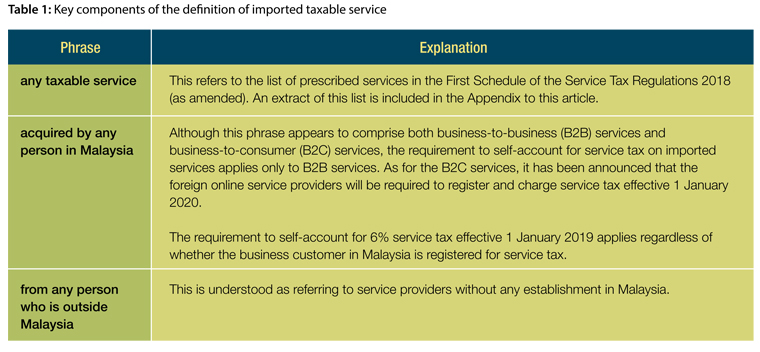

2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. This tax is not a final tax and will be refunded to the contractor upon finalization by the tax authorities payments made by malaysian residents to non resident contractors for services under a contract carried out and performed in malaysia are subject to withholding tax of 13 10 3 on the service portion of the contract. Denotes section in the income tax act ita ita denotes income tax act. Malaysia taxation and investment 2018 updated april 2018 3 principal hubs the government has issued detailed guidelines including the revised guidelines for principal hubs dated 7 july 2017 for tax incentives to promote the establishment of principal hubs in malaysia.

Irbm denotes the inland revenue board of malaysia. Our management team consists of licensed tax agents and chartered accountants please contact us if you need assistance with the topic above. Income that a nonresident derives from malaysia from special classes of income is subject to tax in malaysia. The income tax act 1967 provides that where a person referred herein as payer is liable to make payment as listed below other than income of non resident public entertainers to a non resident person nr payee he shall deduct withholding tax at the prescribed rate from such payment and whether such tax has been deducted or not pay that tax to the director general of inland.

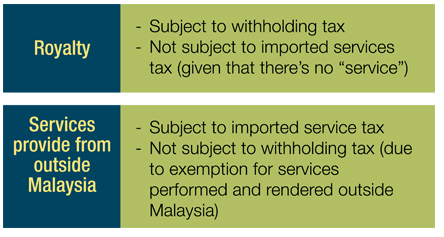

This deduction of tax at source does not represent a final tax which is determined upon the filing of the tax return. Payer refers to an individual body other than individual carrying on a business in malaysia. Malaysia payment is subject to withholding tax under 2 1 1 section 109 income tax act 1967 the act if the payment received is a royalty income under the act. Payments made to non residents in respect of the provision of any advice assistance or services performed in malaysia and rental of movable properties are subject to a 10 wht unless exempted under statutory provisions for purpose of granting incentives.

Or 2 1 2 section 109b of the act if the payment received is an income within the scope of paragraph 4a ii of this act. Income attributable to a labuan business.