How To File Tax For Sole Proprietorship In Malaysia

And as corporate taxes are falling companies will be.

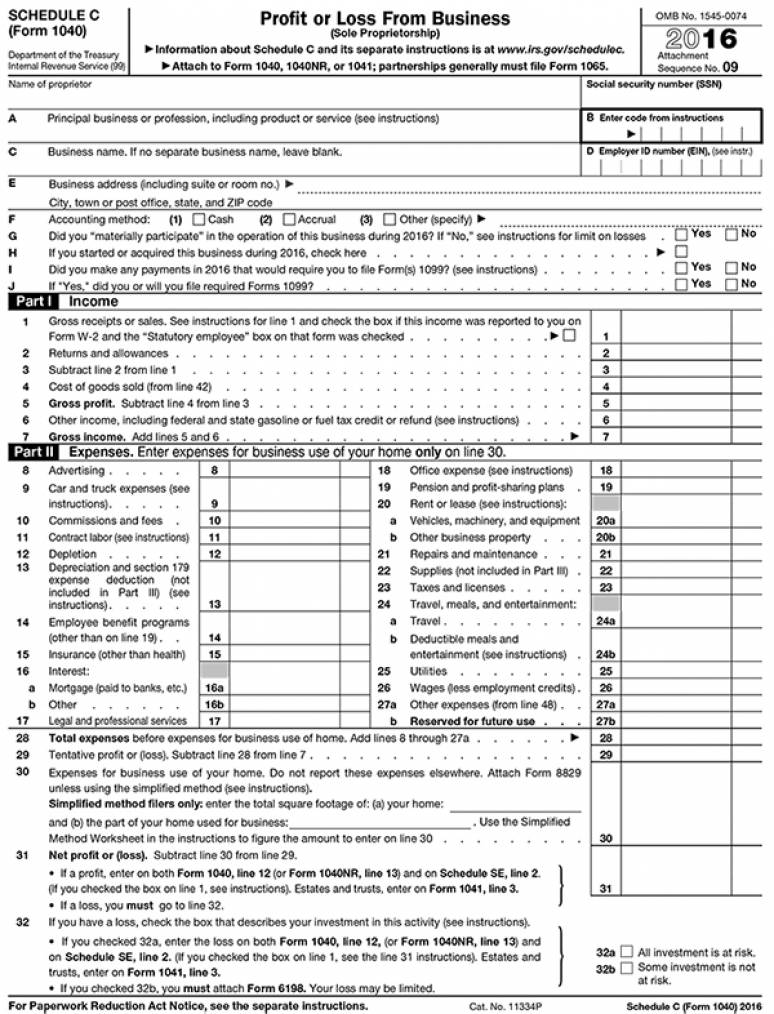

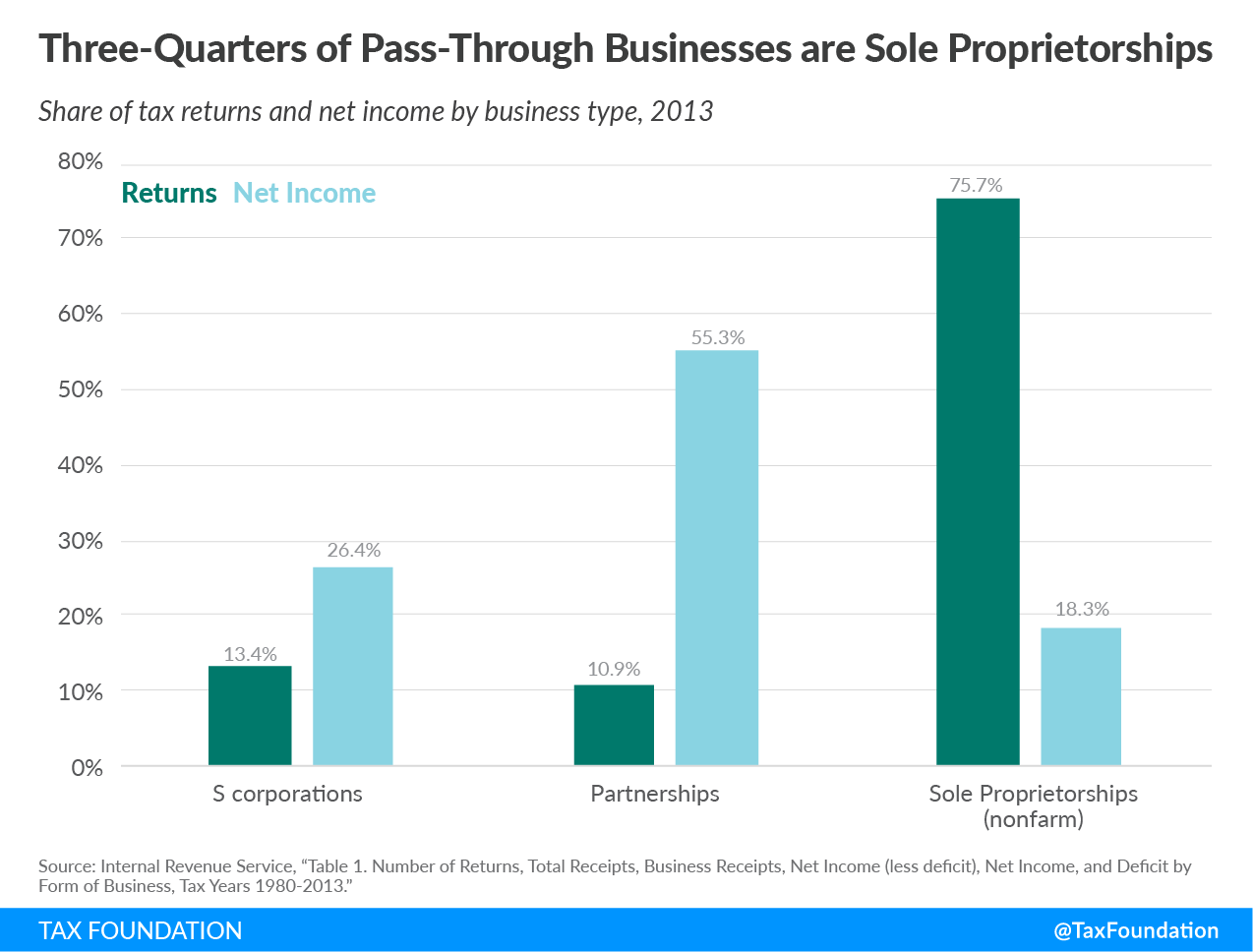

How to file tax for sole proprietorship in malaysia. Use form cp 600pt. An important aspect referring to the incorporation of a sole proprietorship here is that foreign persons are not allowed to incorporate this. This page shows the relevant information to help you prepare and file your tax return. A sole proprietorship in malaysia makes no difference between the natural person who owns it and the business sole proprietorships are pass through entities.

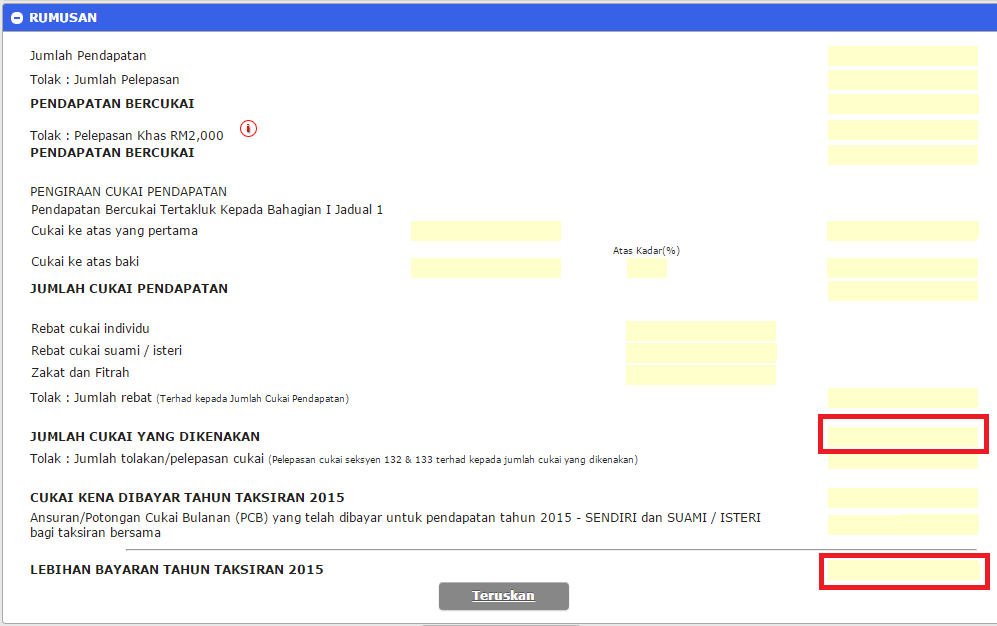

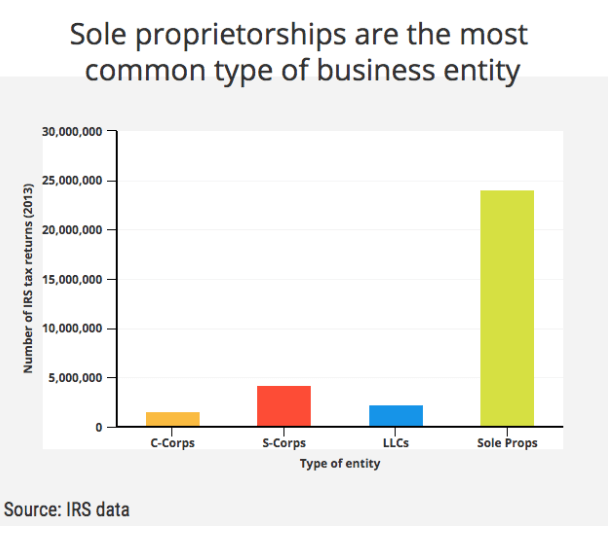

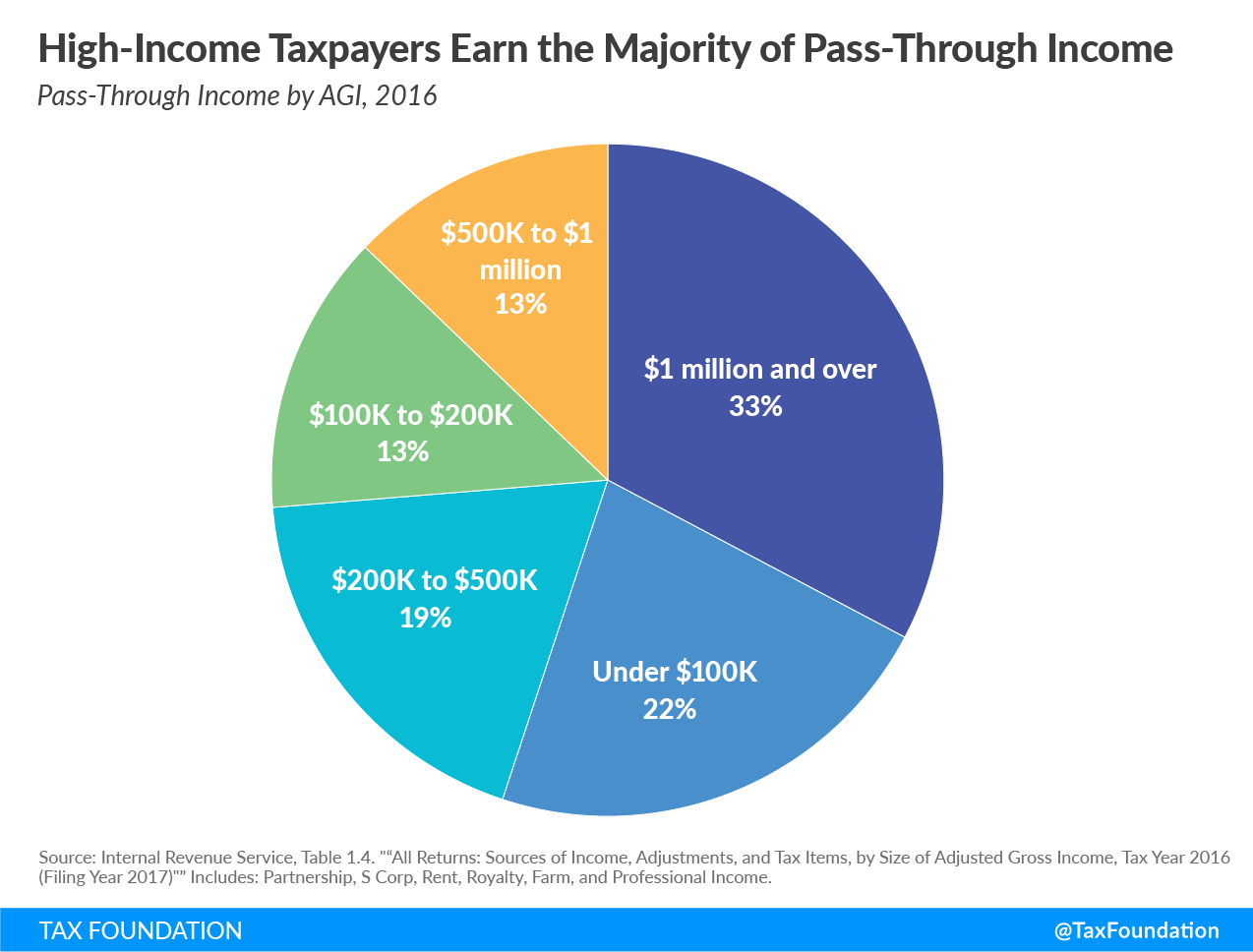

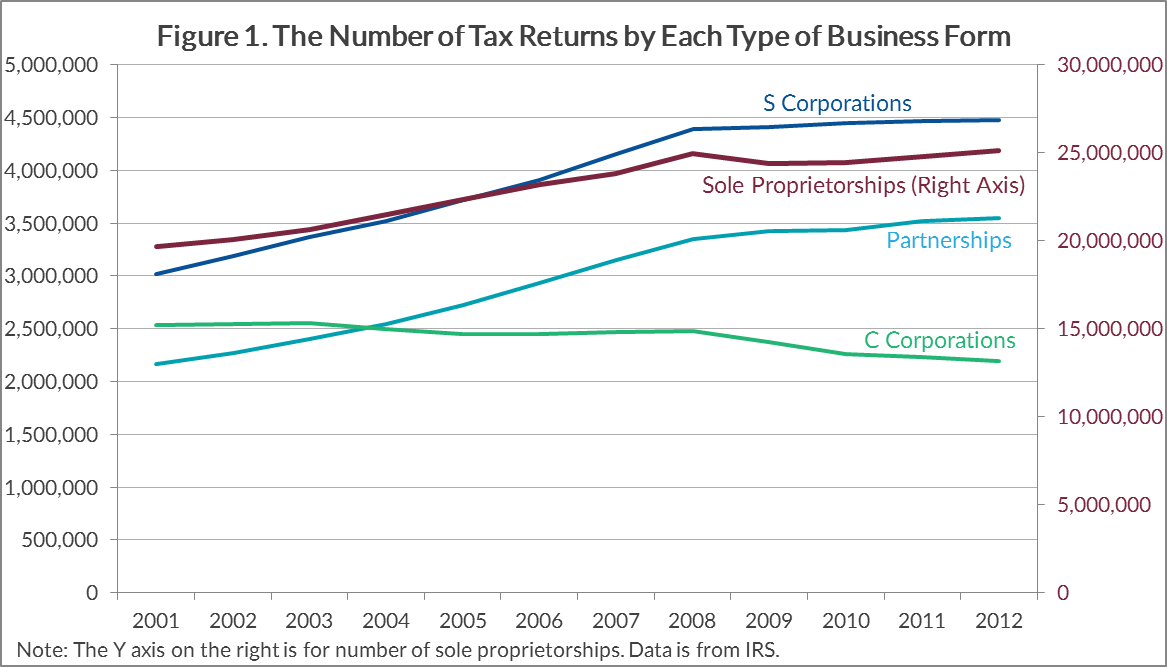

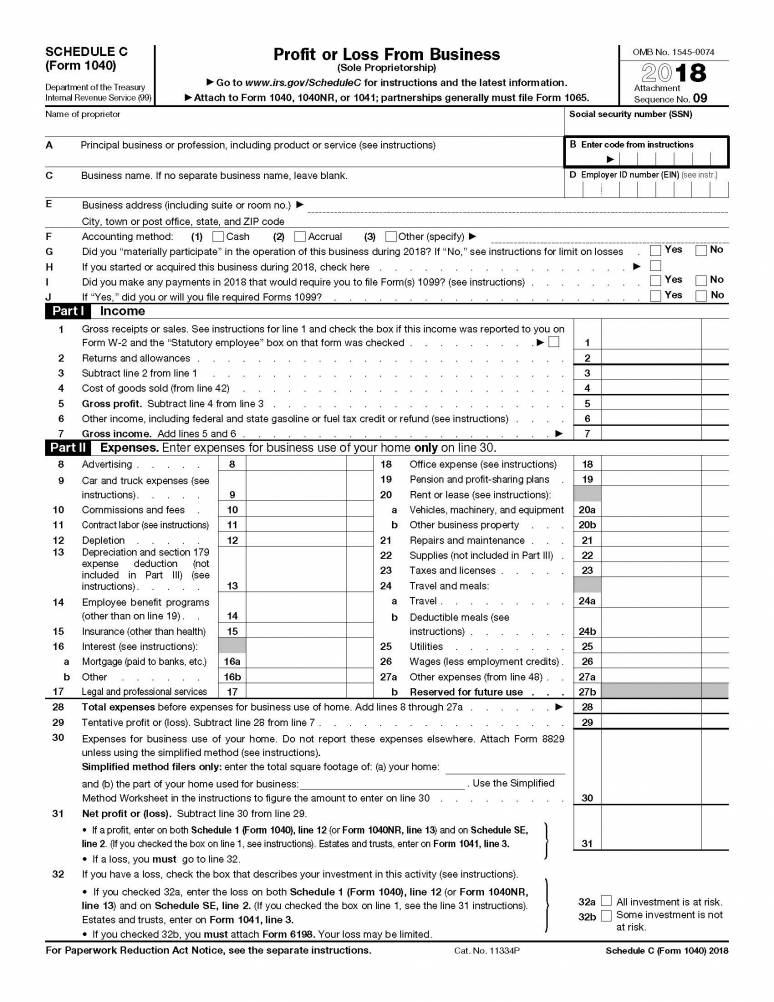

Consequently if you simply decide to cease doing business the sole proprietorship comes to an end. Sole proprietorships law in malaysia let s begin by defining what a sole proprietorship is it is basically a type of business in malaysia and that particular business is owned by a person. The cost evaluation is marginal and way lower when compared with other form of business in this nation. Thereby no separate tax return file is needed sole proprietorships in malaysia are charged the income tax on a gradual scale applied to individual income from 2 to 26.

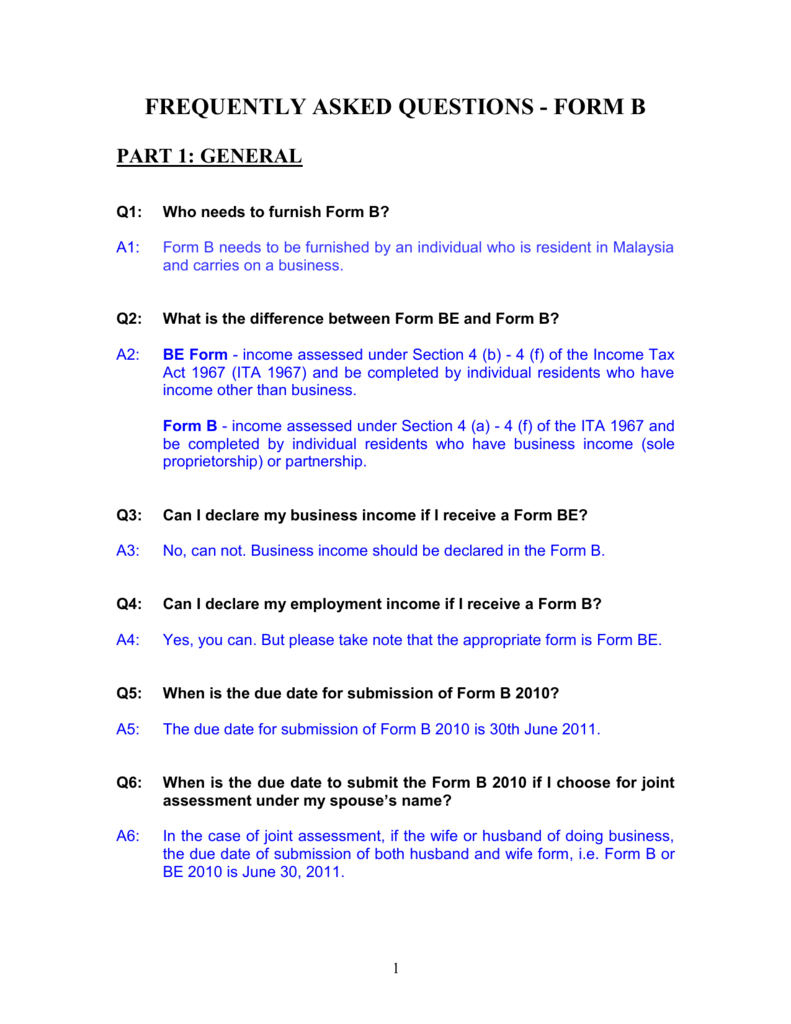

You have to report this income in your tax return. For many small scale online businesses in malaysia sole proprietorship single owner or partnership more than one owner is enough and the cheapest option. It costs rm 10 and takes just a few minutes. As the owner of a sole proprietorship you account for both income and losses on your individual tax return.

All profits and losses go directly to the business owner. A sole trader is represented by the natural person who will carry business operations in his or her own name. Bhd berhad all declare it under their own company name and pay corporate tax. Please note sole proprietor and partnership declare their tax under business section of their personal income tax.

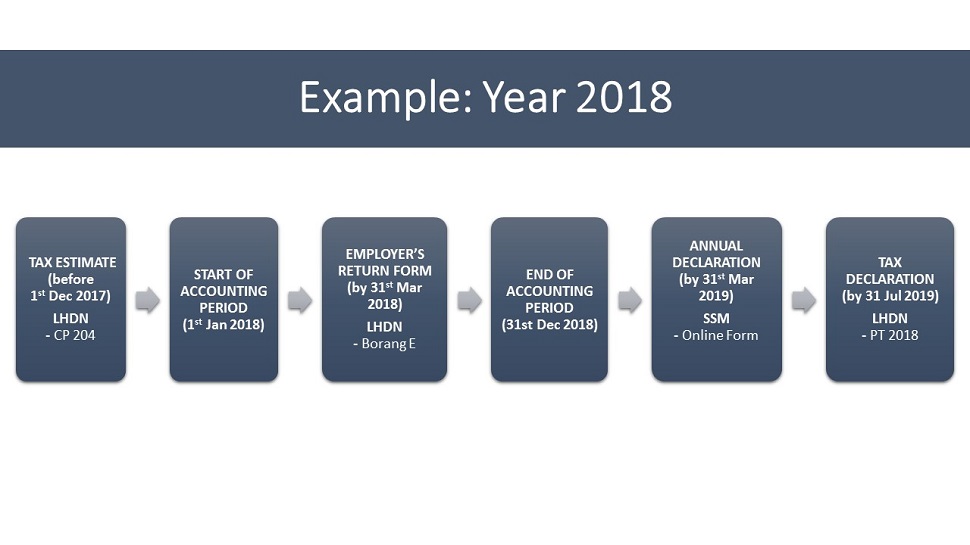

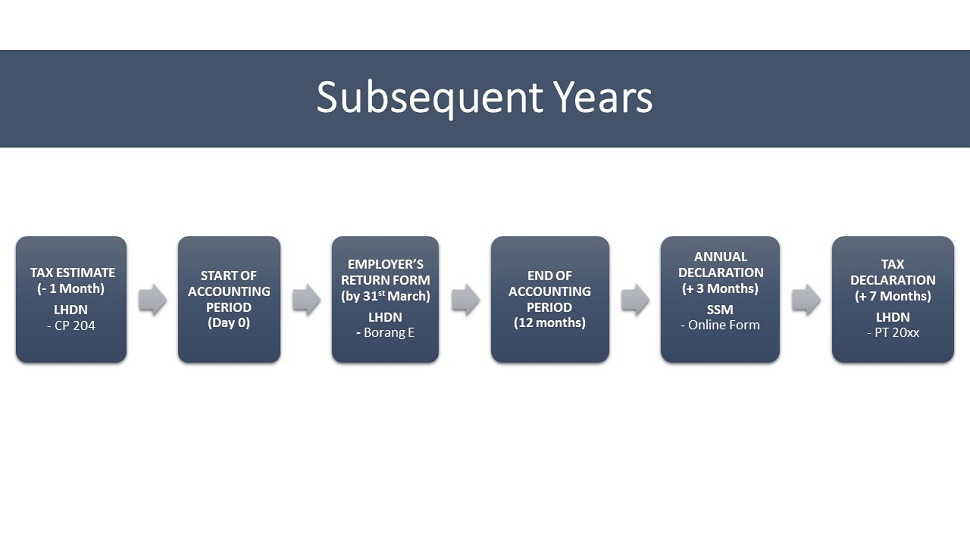

A sole proprietorship must be registered with the companies commission malaysia the main institution where companies file for registration. Tax file register your llp for a tax file at a nearby lhdn branch. You ll also need to submit copies of your llp certificate from step 1 and stamped llp agreement. Companies pay tax of 26 ya2008 and shareholders receive a net dividend that is exempt from tax and does not need to be filed with the irb shareholders who fall into higher tax brackets higher than 26 are essentially getting a saving on the difference.

Usually you dont hire accountants for sole proprietorship unless you have so many receipts and making big bucks. Br as like other business proprietor also faces problem of debt collection. Sole proprietorships are not legally separate from the owner of the business. Sole proprietorship malaysia comes with enticing policies where the owner of the company doesn t need to corporate tax.

If you have received full time or part time income from trade business vocation or profession you are considered a self employed person.