Epf Withdrawal For Housing Loan

The employee s provident fund epf scheme allows an individual save towards retirement.

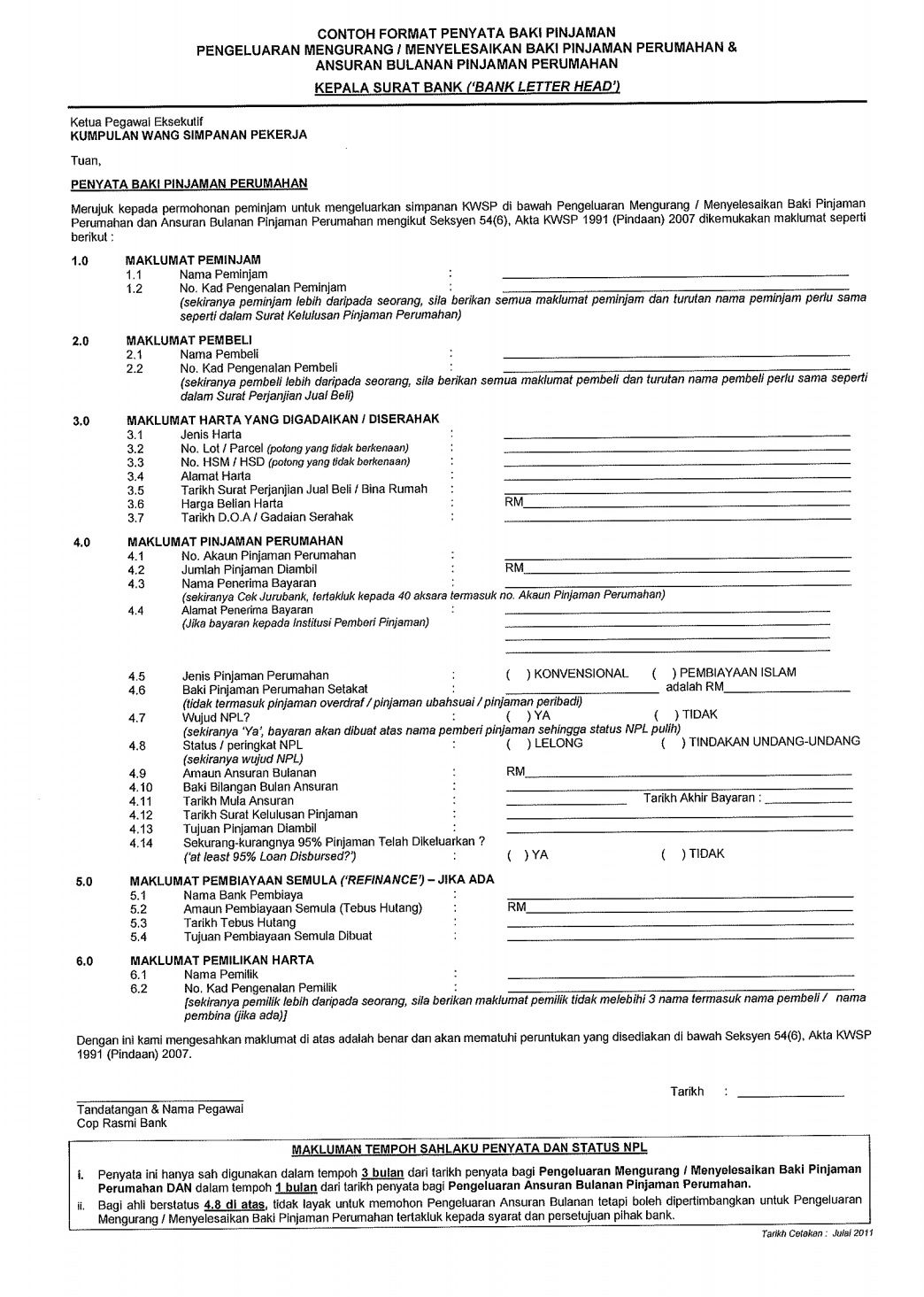

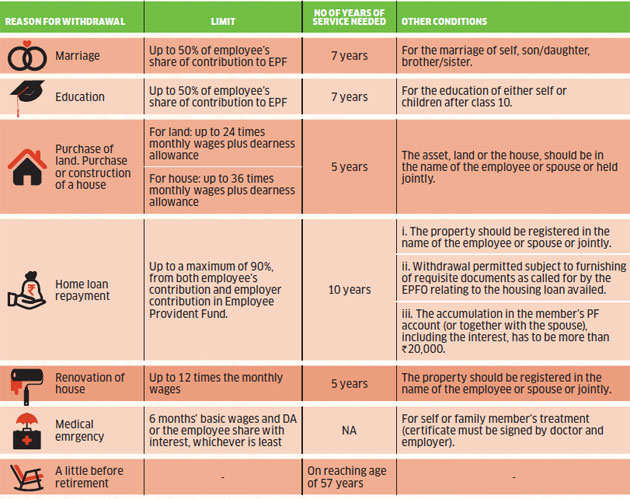

Epf withdrawal for housing loan. Minimum of 10 years in epf no of installments. The full list of t cs plus the necessary supporting documents can be found at kwsp 9c ahl d8 withdrawal form of kwsp s website. Process to withdraw the epf amount for repayment of home loan. The maximum you may withdraw under a zero down home loan is 10 of the home price to help pay for entry costs and other fees.

Declaration form from member amount eligible. You spouse has a housing loan account with a panel bank appointed by the epf. Epf amount can be also withdrawn for repaying the existing housing loan taken by the member. Min is 8 to 12 epf is 6 for year 2011 around 5 to 6 over past few years.

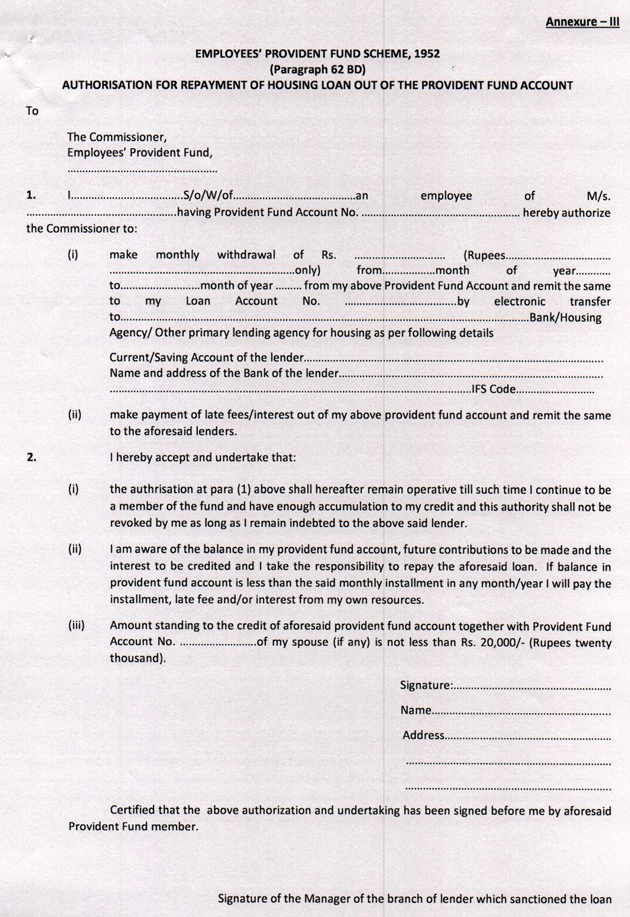

Follow these simple steps to utilize your epf for repaying your home loan as per the updated epf withdrawal rules a pf member can apply for the loan through the housing society to the epf commissioner in the format prescribed in annexure 1. The commissioner issues a certificate specifying the monthly contribution of the last 3 months. 36 month s basic wages da or total employee employer share with interest or total outstanding loan amount with interest whichever is lower. Epf withdrawal for repay housing loan modifying existing house purchasing sponsored links.

She he needs to. Epf allows members to make a partial or full withdrawal from their savings to pay for specific needs under medical housing loans and education. Those who want to opt for offline mode are required to submit a physical application. 12 of the employee s basic salary and dearness allowance da is contributed by the employee and employer towards the scheme every month.

2 buying a home as an individual you may withdraw the difference between the price of the home and the loan amount plus 10 of the home purchase price or all the money in account 2 whichever is lower and not less than rm500. Members can withdraw the existing amount to be used in repaying an already prevailing house loan. All withdrawal payments will be credited directly into yours or your spouse s housing loan account when you meet the following criteria. Better withdraw from epf account 2 to housing loan as following points.

Withdrawal to pay down housing loan monthly installment. One or more document required with form 31. One can withdraw from pf epf account for loan repayment in two ways offline and online. However there certain procedures and criteria that one is required to carefully follow.