Epf Contribution Rate 2019 Malaysia

Updated pcb calculator for ya2019.

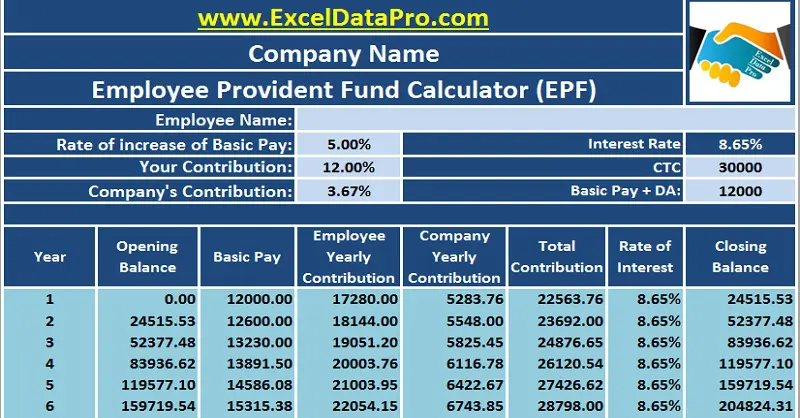

Epf contribution rate 2019 malaysia. According to the epf this move to reduce statutory contribution rates follows the government s proposal to help increase the take home pay of employees who continue working after age 60 as proposed during the tabling of budget 2019 on 2 november 2018. Employees provident fund malaysia epf is a federal statutory body under the purview of the ministry of finance employees provident fund epf will allow education withdrawals for professional certificate programmes under budget 2020 every company is required to contribute epf calculator for its staff workers and to remit the contribution sum to kwsp before the 15th day of the following. Third schedule subsection 43 1 rate of monthly contribution part a the rate of monthly contribution specified in this part shall apply to a employees who are malaysian citizens. The employees provident fund act 1991 is amended by substituting for the third schedule the following schedule.

The new rates will commence with malaysian workers january 2019 pay in time for the february 2019 contribution. The employees provident fund. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule.

Removed ya2017 tax comparison. Employers are required to remit epf contributions based on this schedule. Epf tax relief limit revised to rm4000 per year. For all your contributions the government guarantees a minimum paid dividend rate of 2 50 for simpanan konvensional.

The move to reduce the statutory contribution rates follows the government s proposal during the tabling of budget 2019 to. The malaysian government has reduced the minimum employee contribution rate for the employees provident fund epf to 7 starting from april 1 in a bid to cushion the impact of the covid 19. Currently employees contribute 11 of their salary to epf while employers must put in a minimum of 12 for salaries more than rm5 000 and 13 for salaries lower than that. The minimum employers share of epf statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the employees share of contribution rate will be zero per cent.

For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12.