Epf Withdrawal For Housing Loan Documents

The employee s provident fund epf scheme allows an individual save towards retirement.

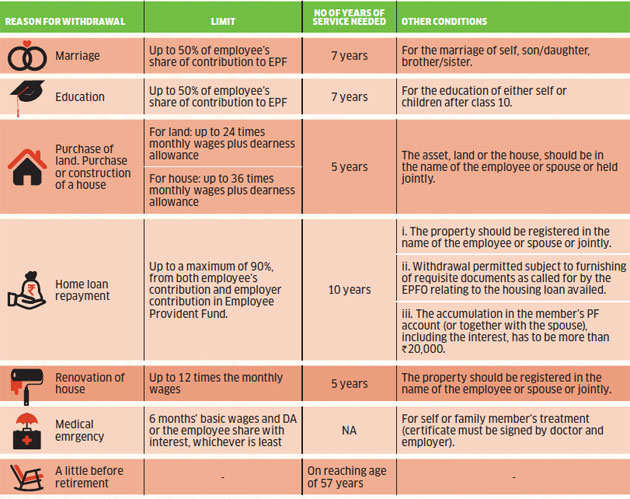

Epf withdrawal for housing loan documents. The government it seems is pulling out all the stops in making housing for all by 2022 a success. You do not have arrears for your housing loan. The contributory employees to dip into their retirement savings to own a home of their own. 36 month s basic wages da or total employee employer share with interest or total outstanding loan amount with interest whichever is lower.

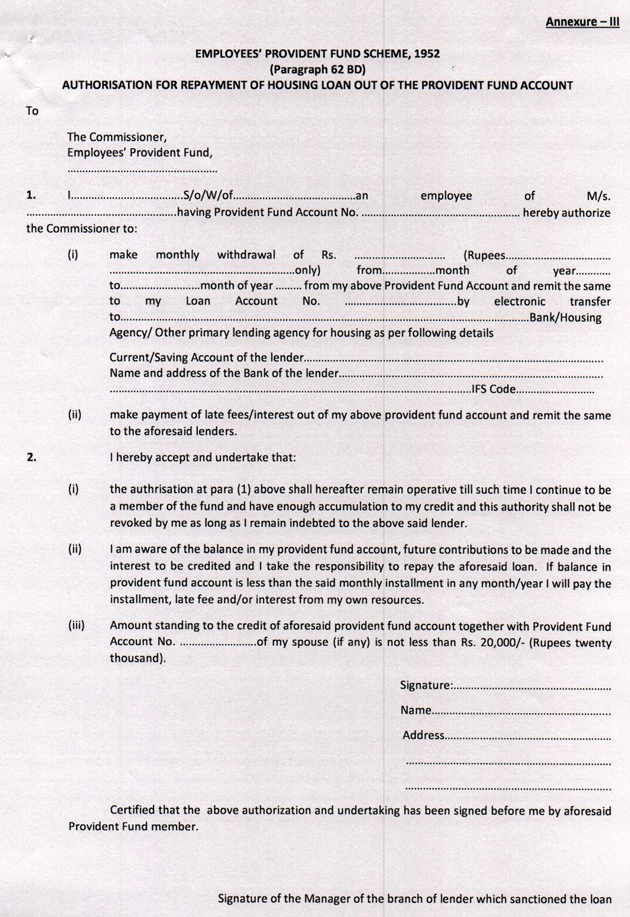

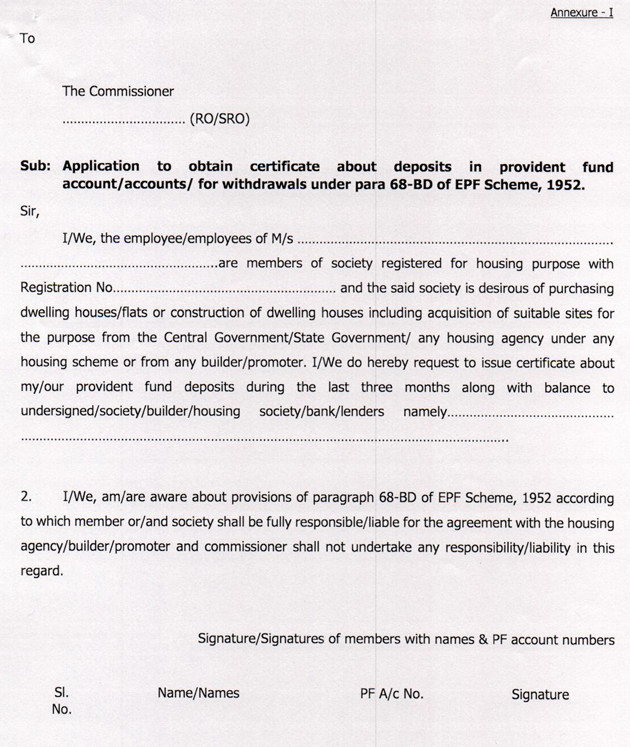

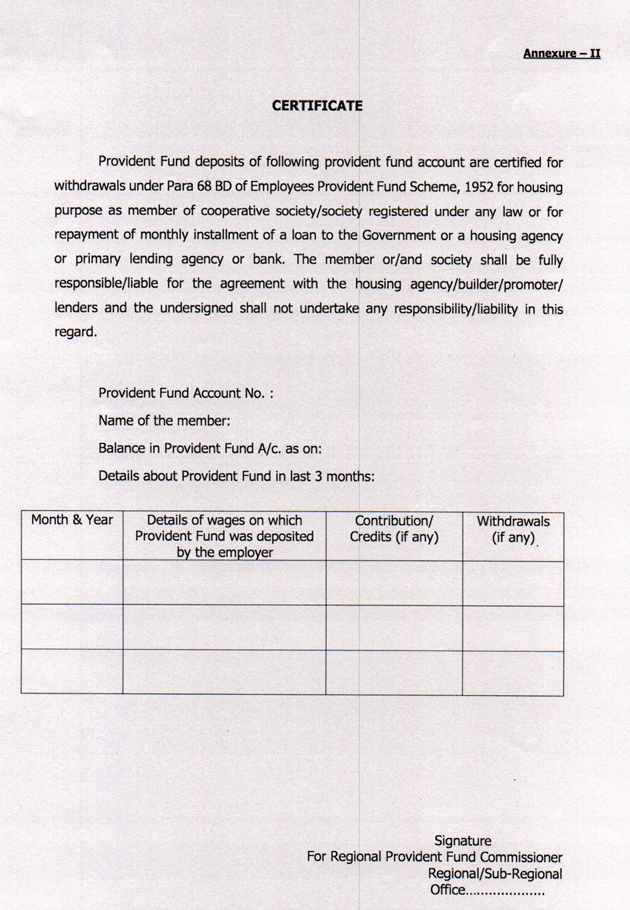

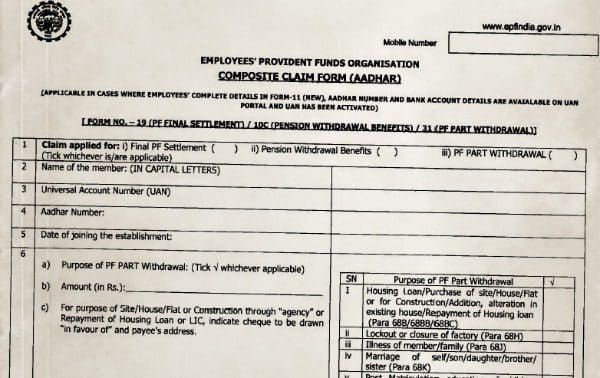

Declaration form from member amount eligible. The commissioner issues a certificate specifying the monthly contribution of the last 3 months. To facilitate epf members in preparing for a comfortable retirement the epf allows you to make a partial or full withdrawal from your savings to meet the specific retirement related needs that are in line with the epf s current policies. Withdrawal to pay down housing loan monthly installment.

Deed of agreement of sale and purchase build house. Bank confirmation letter housing loan statement. 12 of the employee s basic salary and dearness allowance da is contributed by the employee and employer towards the scheme every month. Process to withdraw the epf amount for repayment of home loan.

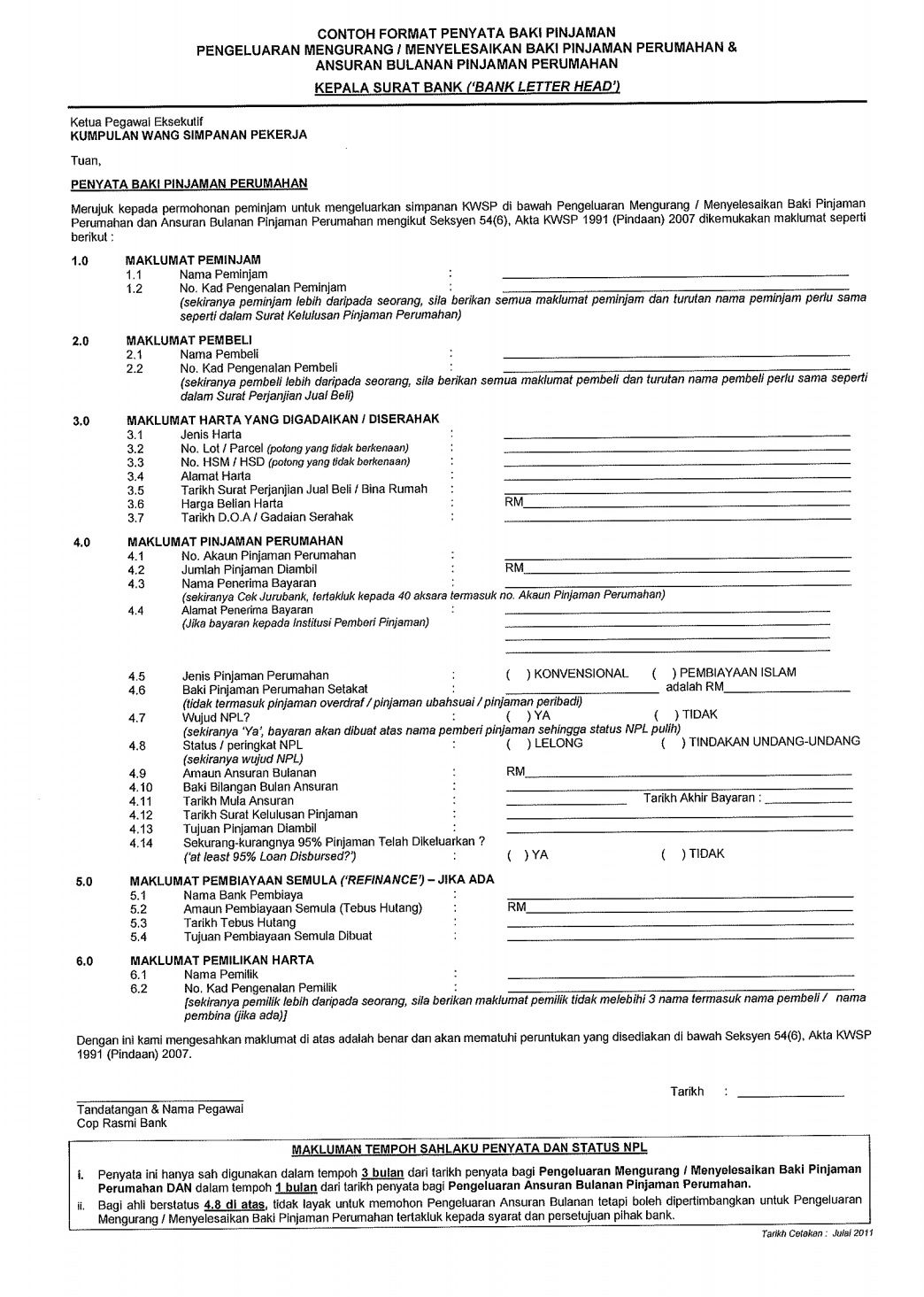

Epf amount can be also withdrawn for repaying the existing housing loan taken by the member. A photocopy of the bank book for your active account. Minimum of 10 years in epf no of installments. In the case of re financing the loan balance accounted for is based on the original housing loan payment from the first loan provider or the latest loan balance whichever is lower.

The contributory employees of the provident fund pf scheme to use 90 percent of epf accumulations to. Kwsp form 9p ahl a photocopy of mykad ic. Is it good to withdraw pf for a home loan. However to apply for this withdrawal service of at least 3 years is required.

This scheme is an addition to the above scheme withdrawal to reduce redeem housing loan and allows you to set up a standing instruction for money from account 2 to be directly paid to the bank or. One or more document required with form 31. If several loan providers are involved the loan redemption letter will be compared against the latest balance to determine the eligible withdrawal amount. The initiative gets a shot in the arm by allowing members of epfo i e.

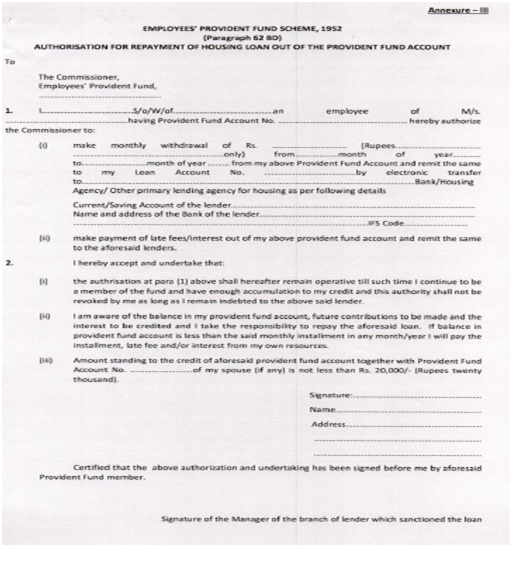

Follow these simple steps to utilize your epf for repaying your home loan as per the updated epf withdrawal rules a pf member can apply for the loan through the housing society to the epf commissioner in the format prescribed in annexure 1. Epfo has allowed members i e. Epf withdrawal rules for home loan repayment a member can withdraw up to 90 per cent of the total epf amount to pay back home loans provided the house is in the name of the member or is held jointly with a spouse. The maximum you may withdraw under a zero down home loan is 10 of the home price to help pay for entry costs and other fees.