Inland Revenue Board Of Malaysia Withholding Tax

Quoting directly from the inland revenue board of malaysia s official website withholding tax is an amount that is withheld by the party making payment payer on income earned by a non resident payee and paid to the inland revenue board of malaysia irbm.

Inland revenue board of malaysia withholding tax. Inland revenue board of malaysia date of issue withholding tax on special classes of income public ruling no. On 7 july 2017 the inland revenue board of malaysia irbm published practice notes1 2017 and 2 2017 of 23 june 2017 which offer guidance on the withholding of tax for contracts or services provided outside malaysia effective from 17 january 2017. 23 january 2014 director general s public ruling a public ruling as provided for under section 138a of the income tax act 1967 is issued for the purpose of providing guidance for the public and officers of the inland revenue. Payments made to non residents in respect of the provision of any advice assistance or services performed in malaysia and rental of movable properties are subject to a 10 wht unless exempted under statutory provisions for purpose of granting incentives.

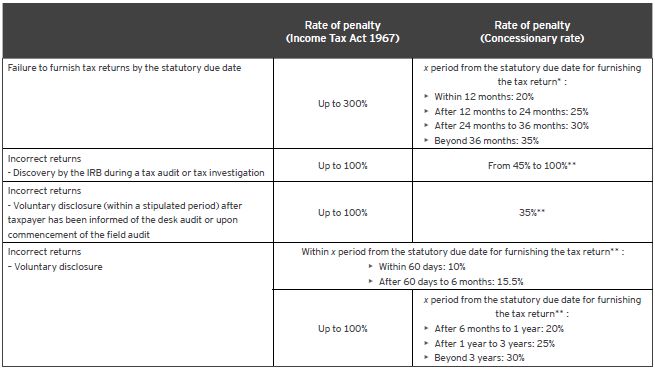

Details of the practice notes are summarized below. Relevant provisions of the law 1 3. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. Malaysian inland revenue board s frequently asked questions faqs on taxation matters during the movement control order mco period updated on 3 april 2020 on 18 march 2020 the malaysian inland revenue board mirb has released a list of faqs in relation to the.

1 2014 last amended on 27 june 2018. Inland revenue board of malaysia withholding tax on special classes of income public ruling no 11 2018 date of publication. The inland revenue board irb of malaysia issued public ruling pr no. Withholding tax is an amount withheld by the party making payment payer on income earned by a non resident payee and paid to the inland revenue board of malaysia irb.

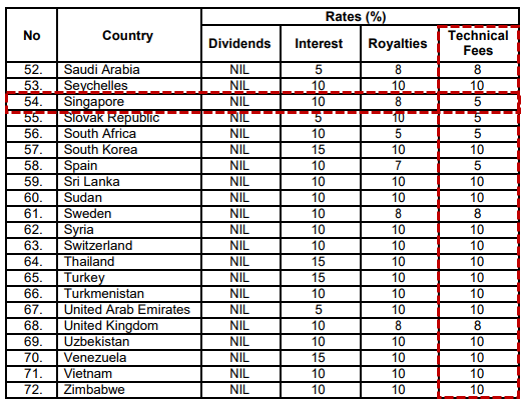

What is withholding tax in malaysia. Withholding tax to the inland revenue board of malaysia irbm within one month from the date of paying or crediting whichever is earlier. Generally any person making certain payments such as royalties interest contract payments remuneration to a public entertainer technical and management fees to non residents is required to remit the tax deducted at an applicable rate i e. Payer refers to an individual body other than individual carrying on a business in malaysia.

5 december 2018 contents page 1. 11 2018 on 5 december 2018 which supersedes the previous guidance on nonresident withholding tax on special classes of income pr no.