Epf Contribution Rate 2019 20 In Excel

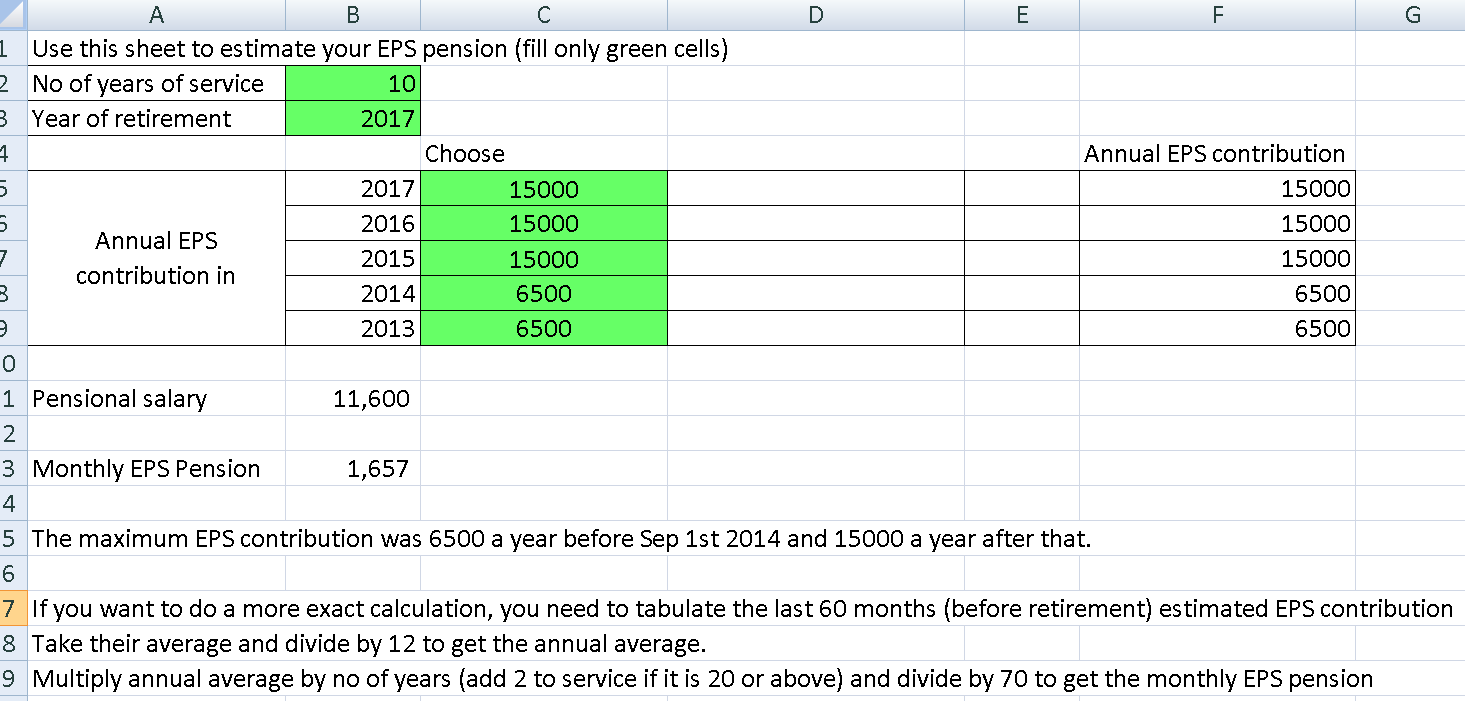

Hopefully this epf calculator excel sheet will help you understand the retirement savings product employee provident fund epf better and also act as a decision making tool to make informed investment decisions about how much you can save in epf corpus for retirement.

Epf contribution rate 2019 20 in excel. For more information check out related articles uan registration uan login pf balance check epf claim status. As an employee we would like to know how much provident fund has been accumulated during the years of service. For the financial year 2019 2020 the pre fixed rate of interest offered by the epf scheme is 8 55. Epf account number contribution rate.

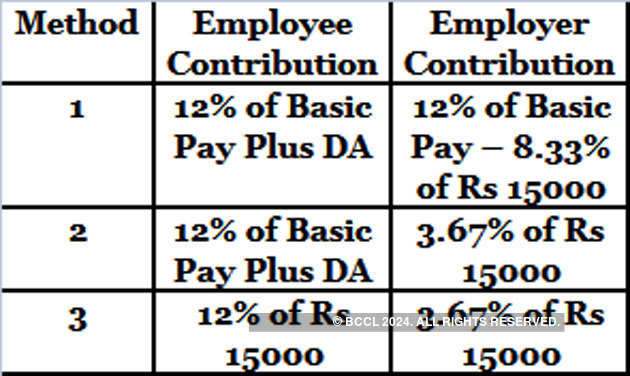

Such contribution above the mandatory 12 per cent is considered as a voluntary provident fund vpf. An employer has to match the employee s contribution of 12 per cent of employees basic pay however the employer is not obliged to match employee s higher contribution towards vpf. Employers are required to remit epf contributions based on this schedule. If the employer pays a higher amount the employer does not have to pay a higher rate as well.

Under epf the contributions are payable on maximum wage ceiling of rs. 15000 the employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate. Contribution for epf. The latest epf interest rate is 8 50 for the financial year 2019 20.

Here you can find the epf ecr calculation sheet with formulas for the year 2019. This rate changes according to decisions made by epfo. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download. The epf receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non pensionable public sectors as well as voluntary contributions by those in the informal sector.

Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. Epf ecr file also known as the pf calculation sheet which is used to create epf contributions text file and it is further used to create monthly epf challans. Many of the employee and employer s especially new to this field may not be aware of the epf account number contribution rate here in this post we ll discuss the account numbers and usage of these accounts while depositing the epf challan on the unified portal. Download ecr file format in excel format.

The contributions towards vpf may be modified annually by the employe.