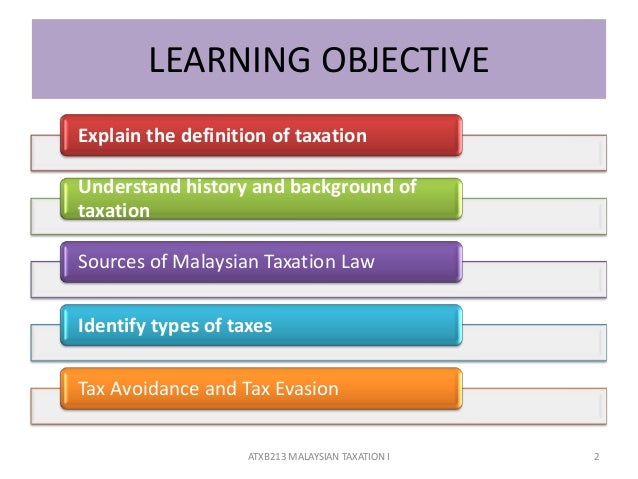

Types Of Tax In Malaysia

In malaysia whether you buy or sell the property you must face the property taxes.

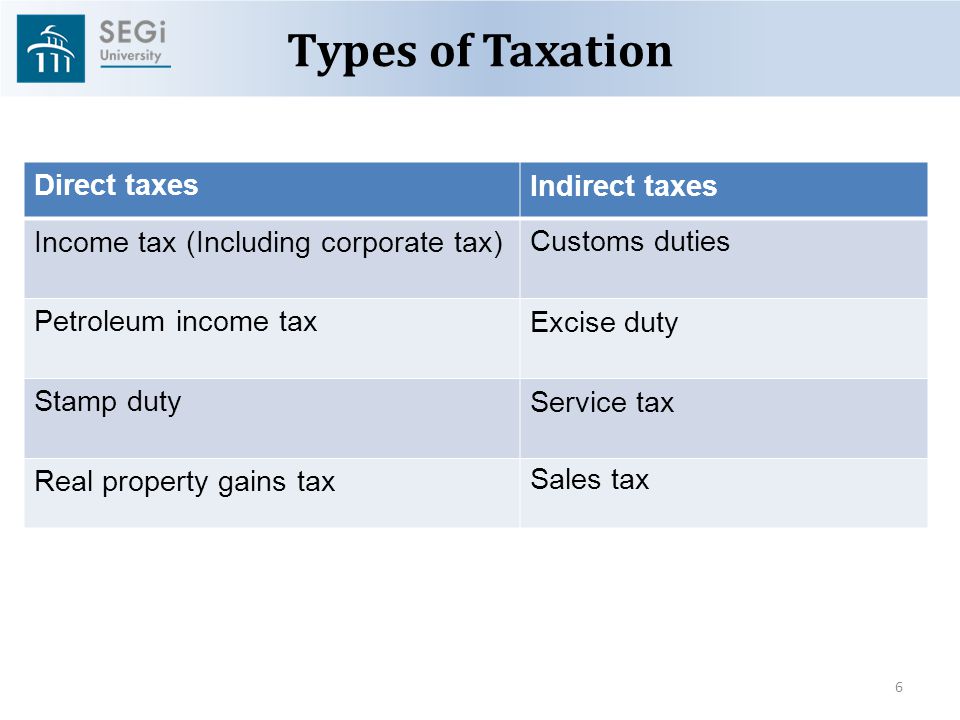

Types of tax in malaysia. Restrictions apply on maximum qualifying capital expenditure. Type of indirect tax. Any work or professional service performed or rendered in malaysia in connection with or in relation to any undertaking project or scheme carried on in malaysia are deemed to be services under contract. Contract payments to nr contractors.

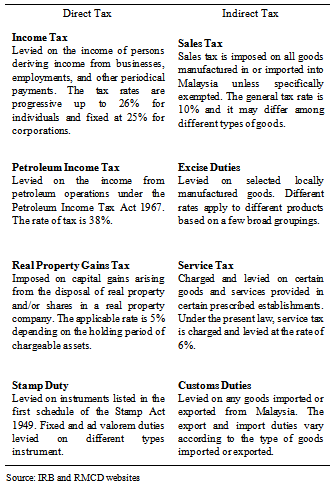

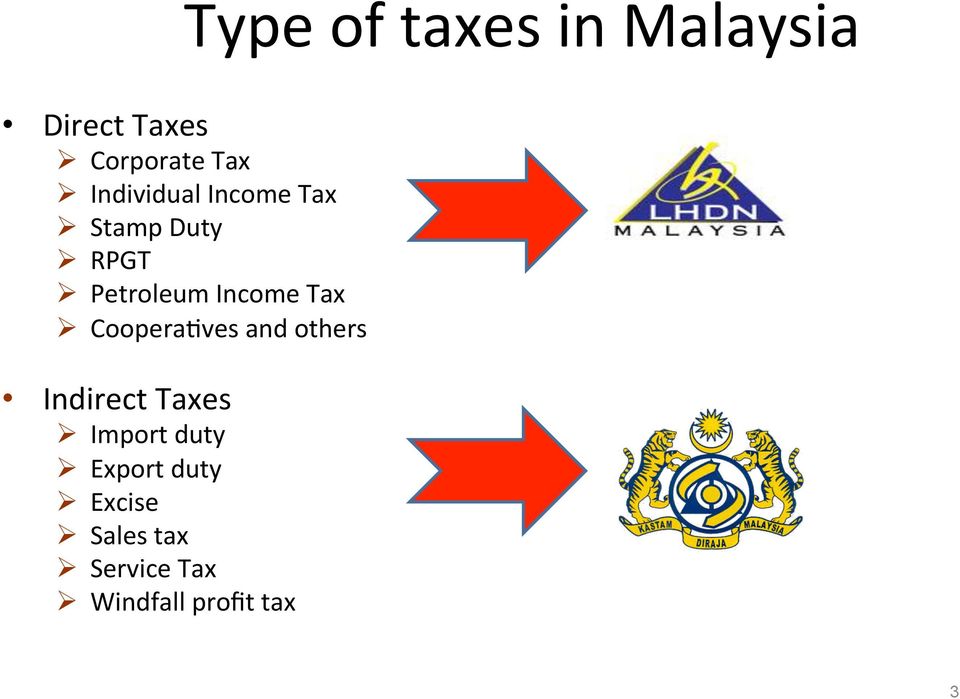

Accelerated capital allowance is available for certain types of industrial building plant and machinery some of which include buildings used as a warehouse buildings used as a school or an educational institution computers information technology equipment environmental protection equipment waste recycling equipment and. It is also commonly known in malay as nombor rujukan cukai pendapatan or no. Sales tax and service tax were implemented in malaysia on 1 september 2018 replacing goods and services tax gst. In addition taxes like estate duties annual wealth taxes accumulated earnings tax or federal taxes are not levied in malaysia.

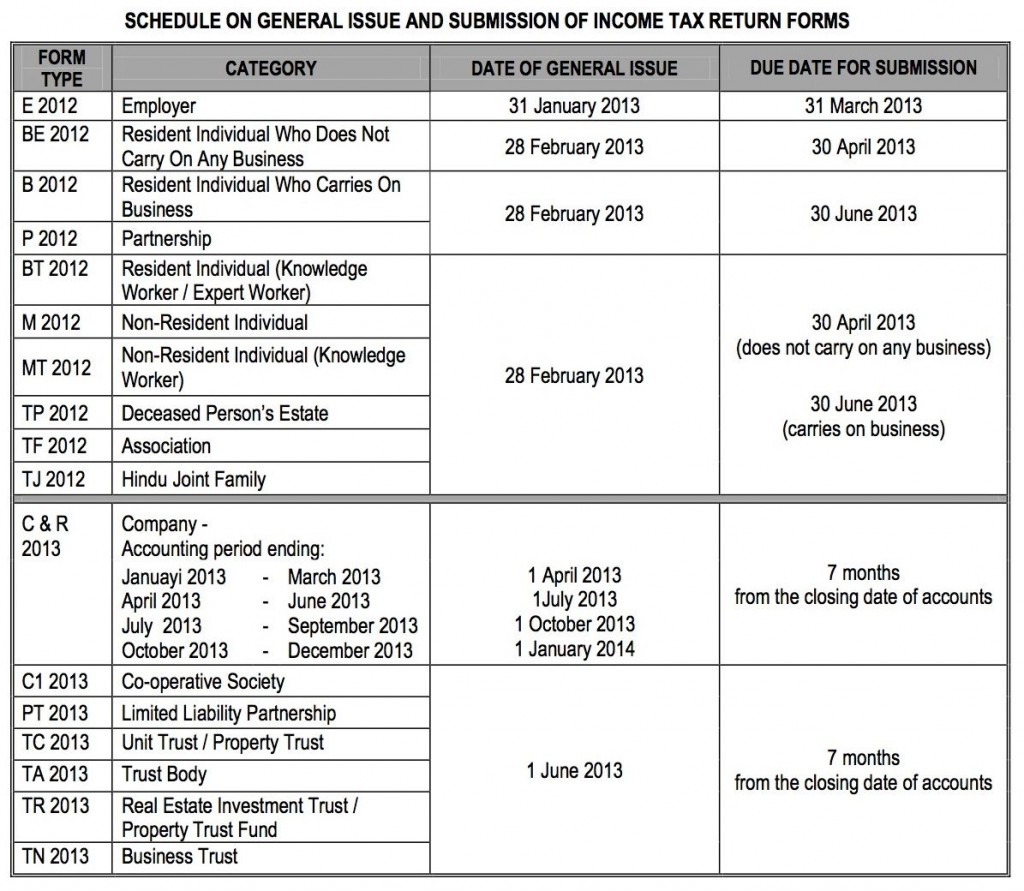

The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. The road tax structure in malaysia varies depending on the type of car its engine capacity the region and the type of ownership. Cars with less than a 1 6 litre engine capacity get charged a fixed base rate which varies depending on the type of car and whether it s a company registered or private vehicle. Lembaga hasil dalam negeri malaysia classifies each tax number by tax type the most common tax reference types are sg og d and c.

What supplies are liable to the standard rate. The income tax with the highest rate only recently being at 28 has been cut down now to 26 for residents and 27 for non residents. Payments made to non residents in respect of the provision of any advice assistance or services performed in malaysia and rental of movable properties are subject to a 10 wht unless exempted under statutory provisions for purpose of granting incentives. Every individual in malaysia including resident or non resident who is liable to tax is required to declare his income to inland revenue board of malaysia irbm or lembaga hasil dalam negeri malaysia ldhn.

An income tax number or tax reference number is an unique identifying number used for tax purposes in malaysia. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Taxpayer is responsible to submit income tax return form itrf and make income tax payment yearly prior to due date. This section explains the payment types their definition and withholding tax applied.

10 for sales tax and 6 for service tax.