Travelling Expenses Tax Deductible Malaysia

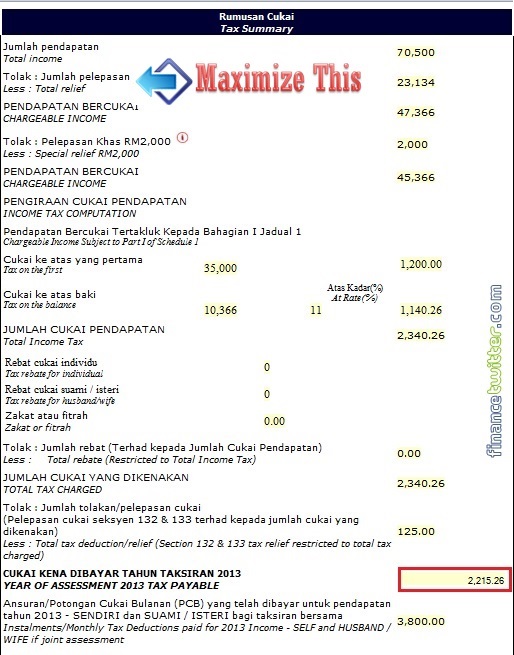

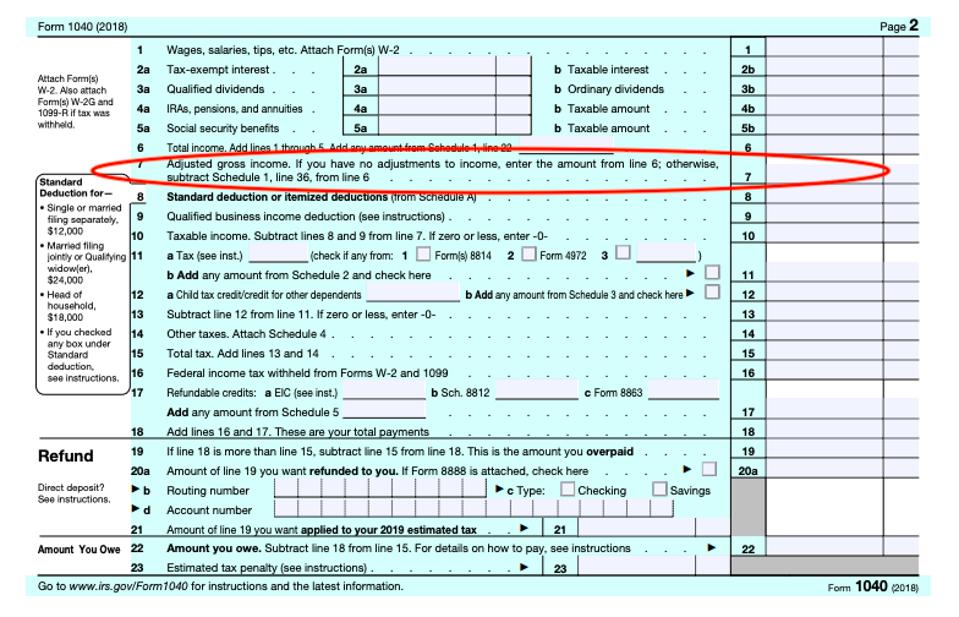

A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax malaysia ya 2019.

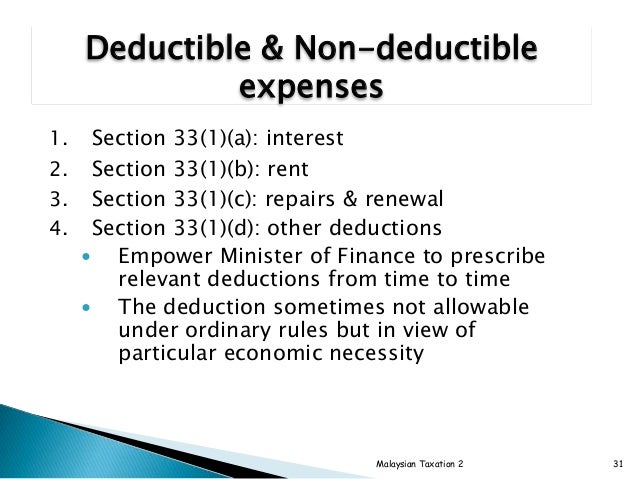

Travelling expenses tax deductible malaysia. Employees are allowed a deduction for any expenditure incurred wholly and exclusively in the performance of their duties but no allowance is given for tax depreciation. Special personal income tax relief for domestic travelling expenses currently traveling expenses both local or overseas are not deductible against income chargeable to tax. Tax deduction for secretarial and tax filing fees. Currently expenses incurred on secretarial and tax filing fees are given a tax deduction of up to rm5 000 and rm10 000 respectively for each year of assessment ya under the income tax deduction for expenses in relation to secretarial fee and tax filing fee rules 2014 p u.

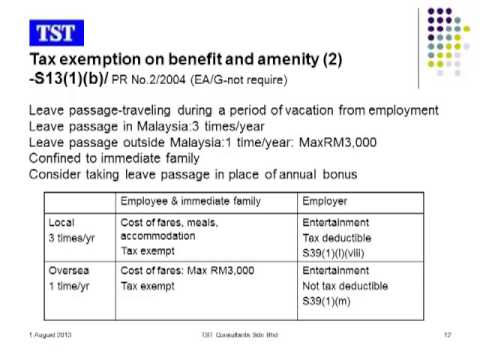

Expenses of a private or domestic nature are expressly excluded from deduction. It is proposed that a special personal income tax relief of up to rm1 000 be given to resident individuals for domestic traveling expenses incurred between 1 march 2020 to. For example the cost of hiring domestic servants to help in housekeeping while one is away at work is not deductible. Income tax exemptions of up to rm1 000 for local travel expenses will also be extended until the end of 2020.

Is the ang pow tax deductible. If the amount received exceeds rm6 000 a year the employee can make a further deduction in respect of the amount spent for official duties. I consider the ang pow as my company s entertainment expense. Relevant provisions of the law 2 1 this pr takes into account laws which are in force as at the date this pr is published.

2 tax treatment of business expenses i p 3 tax treatment of business expenses q r 4 tax treatment of business expenses s z for more information on how to make tax adjustments such as adding back non deductible business expenses to arrive at the income that is chargeable to tax please refer to preparing a tax computation. Petrol card petrol allowance travelling allowance or toll payment or any of its combination for official duties. And b steps to determine the amount of entertainment expense allowable as a deduction. Travel and other expenses.

Real property gains tax rpgt exemption for malaysians for disposal of up to three properties from june 1 2020 to december 31 2021. These are some of the questions commonly asked by my clients my relatives and my friends on the treatment of entertainment expenses. Tax rebate for self if your chargeable income after tax reliefs and deductions does not exceed rm35 000 you will be granted a rebate of rm400 from your tax charged. Records pertaining to the claim for official duties and the.

A the tax treatment of entertainment expense as a deduction against gross income of a business.