Travelling Expenses Tax Deductible Malaysia 2020

Income tax exemptions of up to rm1 000 for local travel expenses will also be extended until the end of 2020.

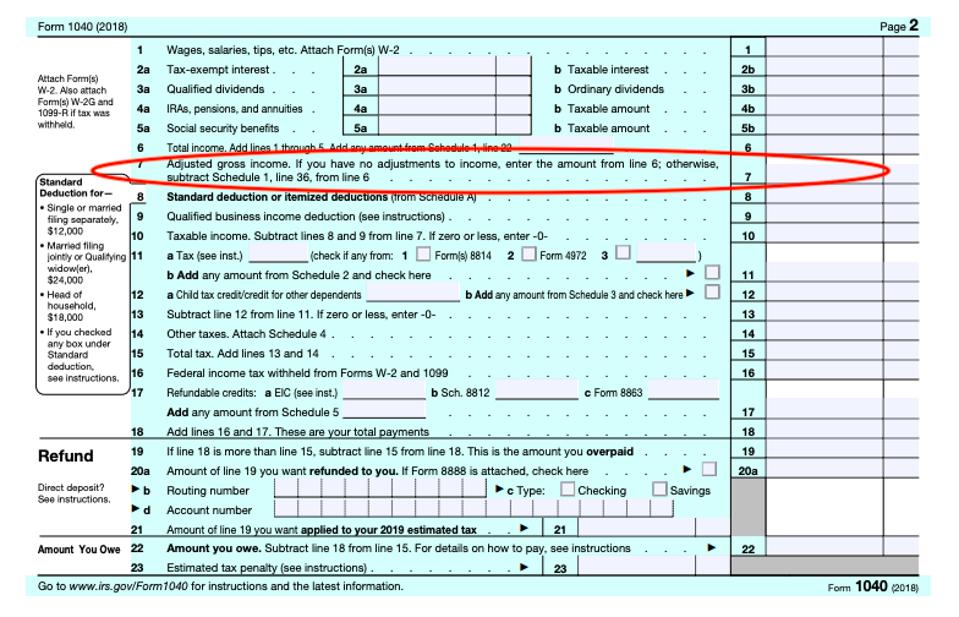

Travelling expenses tax deductible malaysia 2020. Deductions lower your taxable income and reduces your tax burden while tax credits are a dollar for dollar reduction to your tax bill. Updated september 18 2020. Special personal income tax relief for domestic travelling expenses currently traveling expenses both local or overseas are not deductible against income chargeable to tax. A personal tax relief of up to rm1 000 will be given to individuals for the following domestic travel expenses incurred from 1 march 2020 to 31 august 2020.

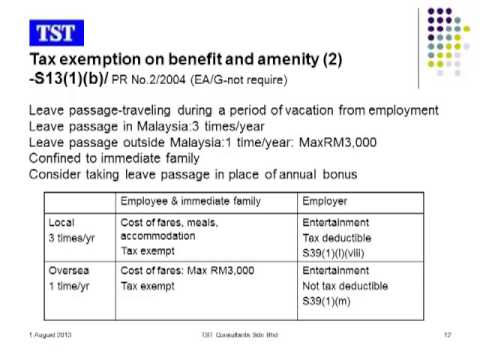

Interim prime minister tun dr mahathir mohamad announced this initiative as part of a strategy to mitigate the impact of the covid 19 virus outbreak on the local tourism industry. For income tax filing in the year 2020 ya 2019 you can deduct the following contributions from your aggregate income. And b steps to determine the amount of entertainment expense allowable as a deduction. It is proposed that a special personal income tax relief of up to rm1 000 be given to resident individuals for domestic traveling expenses incurred between 1 march 2020 to.

Real property gains tax rpgt exemption for malaysians for disposal of up to three properties from june 1 2020 to december 31 2021. Special personal income tax relief for domestic travelling expenses it was announced in the economic stimulus package that a special personal income tax relief of up to rm1 000 be given to resident individuals for domestic traveling expenses incurred between 1 march 2020 to to 31 august 2020. Reliefs ya 2020 myr. Below 18 years of age.

A the tax treatment of entertainment expense as a deduction against gross income of a business. 2 tax treatment of business expenses i p 3 tax treatment of business expenses q r 4 tax treatment of business expenses s z for more information on how to make tax adjustments such as adding back non deductible business expenses to arrive at the income that is chargeable to tax please refer to preparing a tax computation. Spouse under joint assessment 4 000. This has now been extended.

Tax deductions and tax credits can help you save money in tax season 2020. While few people want to pay anything at all there are ways to pay less. I accommodation expenses at premises registered with ministry of tourism arts and culture malaysia. Relevant provisions of the law 2 1 this pr takes into account laws which are in force as at the date this pr is published.

Over 18 years of age who is receiving full time instruction at an establishment of higher education in malaysia at diploma level and higher or outside malaysia at degree level and above or serving under article of indentures in a trade or profession provided certain.