Travelling Expenses Tax Deductible Malaysia 2019

For more details please refer to tax deduction for expenses incurred on renovation or refurbishment works done to your business premises pdf 517kb.

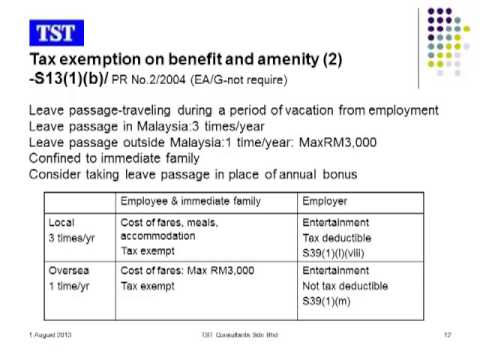

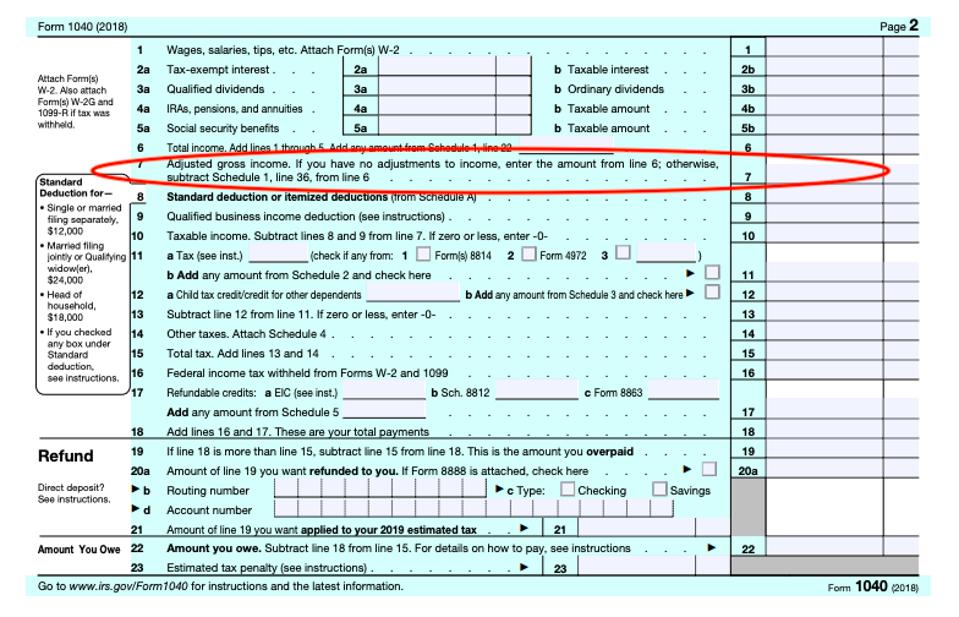

Travelling expenses tax deductible malaysia 2019. A the tax treatment of entertainment expense as a deduction against gross income of a business. There really are a lot of tax reliefs and if you plan your reliefs effectively every year you could be saving thousands in taxes every year. Relevant provisions of the law 2 1 this pr takes into account laws which are in force as at the date this pr is published. Income tax exemptions of up to rm1 000 for local travel expenses will also be extended until the end of 2020.

And b steps to determine the amount of entertainment expense allowable as a deduction. Within 1 year after the end of the year the payment of withholding tax is made. Receiving further education in malaysia in respect of an award of diploma or higher excluding matriculation preparatory courses. Medical expenses for serious diseases for self spouse or child.

Deduction allowed once in every 2 years of assessment 1 000. 2018 2019 malaysian tax booklet income tax. G premium for waiver benefit rider and travel and medical expenses insurance are not allowable as a tax deduction. Under the penjana recovery plan there will also be an increase in income tax relief for parents on childcare services expenses from rm2 000 to rm3 000 however this is not applicable when you file this year as it only applies to the year of assessment.

Tax deduction not claimed in respect of expenditure incurred that is subject to withholding tax which is not due to be paid on the day the return is furnished. 26 november 2019 tax treatment on expenditure for repairs and renewals of assets public ruling no. In answering the questions asked by my clients relatives and friends on the tax treatment of entertainment expenses i would normally conclude with a caution on the increasing importance to keep proper records such as invoices receipts and payment vouchers to support the claim and to determine the appropriate tax treatment of entertainment expenses. To provide cash flow relief and encourage businesses to refit their business premises businesses will be allowed the option to claim r r deductions in one year for qualifying expenditure incurred on r r for the ya 2021.

The easiest mistake to make in claiming income tax relief scenario 1 you only have a medical card which you are paying rm 2 000 annually and you put in the entire rm 2 000 under the insurance premium for medical benefit tax relief.