Tax Avoidance In Malaysia

Income tax in malaysia is imposed on income accruing in or derived from malaysia resident and business.

Tax avoidance in malaysia. It was conducted using cross sectional data by observing a final sample of 82 plcs at one point in time. From the perspective of revenue authorities it is equally important to counter tax avoidance. Singapore and the government of malaysia for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income. Upon advice from its tax advisor it undertook the following.

Return form rf filing programme for the year 2020. This item is available to borrow from 1 library branch. Principles and cases represents a specific individual material embodiment of a distinct intellectual or artistic creation found in international bureau of fiscal documentation. Return form rf filing programme for the year 2020 amendment 1 2020 return form rf filing programme for the year 2020 amendment 2 2020.

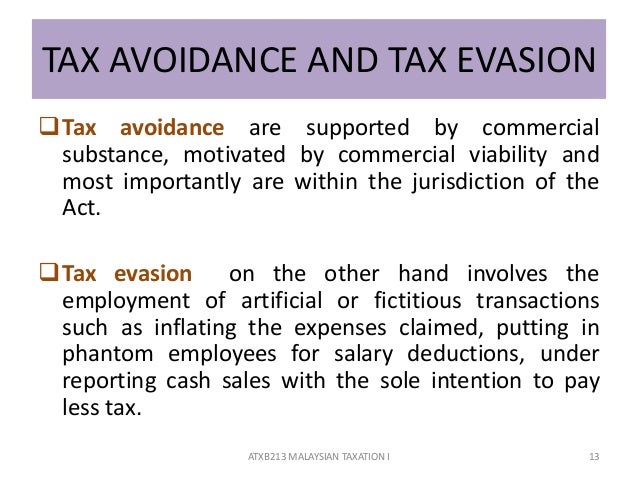

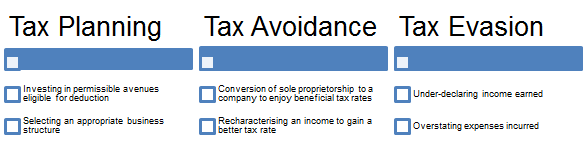

Thus in most tax jurisdictions anti avoidance provisions are included in the tax laws to defeat or pre empt anticipated avoidance schemes mischief or to plug loopholes that have come to light. The item tax avoidance in malaysia. In malaysia there are. Although tax avoidance is acceptable in the eyes of law in malaysia the tax authority taken an extreme change of stance since 2010 and triggered section 140 of the malaysia income tax act more often that it does historically.

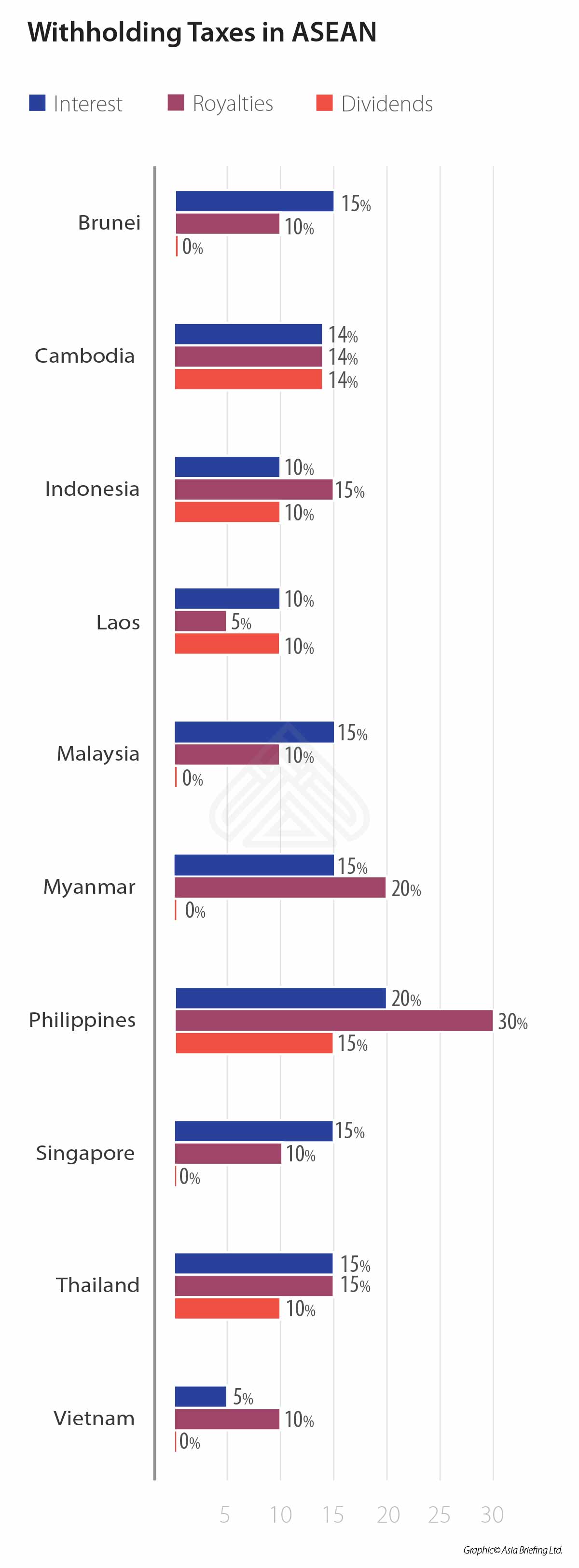

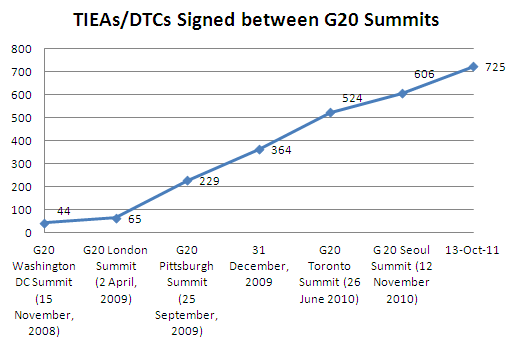

One thing worth mentioning is malaysia has an extensive number of double tax treaties available for the avoidance of double taxation. The text of this agreement signed on 26 december 1968 and is shown in annex a. 2 tax avoidance pwc alert issue 116 october 2014. In malaysia income tax act contains general and specific anti avoidance provision which empowers the director general to disregard schemes that are not commercially justified or are merely set up to avoid tax despite their legal form.

In the remaining parts of the article i will discuss examples of cases that would highlight the good the bad and the ugly of section 140 of the act. However this particular section is far from perfect to deal with tax avoidance issue.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)