Stamp Duty Malaysia 2019

It s can be very confusing at first but once you understand it it s not that difficult.

Stamp duty malaysia 2019. An instrument is defined as any written document and in general stamp duty is levied on legal. Maximize your returns and minimize costs risks when selling property in malaysia. It is only applicable for properties registered with the real estate and housing developers association rehda under hoc 2019. He said the stamp duty waivers are applicable for unsold properties that have been completed or under construction during the six month hoc 2019 period from jan 1 2019 to june 30.

I remember the stamp duty exemption malaysia 2018 is not as complicated as stamp duty exemption malaysia 2019. 2019 stamp duty scale from 1st january 2019 30th june 2019 stamp duty fee 1. Stamp duty exemption list mid small cap plcs for stamp duty exemption the stamp duty exemption will be applicable for trading of companies listed on bursa malaysia securities with a market capitalization ranging between rm200 million and rm2 billion as at 31 december 2019 for eligibility in 2020. Stamp duty exemption on contract notes for sale and purchase transaction of shares of a medium and small capital company in bursa malaysia securities berhad executed from 1 march 2018 to 28 february 2021.

For the last couple of weeks we received numerous questions from you guys on this stamp duty exemption. All instruments chargeable with duty and executed by any person in malaysia shall be brought to the collector who shall assess the duty chargeable. 2019 27 411 904. How will the recent changes in rpgt and stamp duty begin to affect you.

The new stamp duty malaysia 2019 exemption for first time house buyer will be the same as the previous year stamp duty 2018 where for first time home buyers that purchasing residential properties priced up to rm500 000 stamp duty exempted up to rm300 000 on sale and purchase agreements as well as loan agreements for a period of two years until december 2020. In malaysia stamp duty is a tax levied on a variety of written instruments specifies in the first schedule of stamp duty act 1949. For first rm100 000 stamp duty fee 2. Lembaga hasil dalam negeri malaysia tidak bertanggungjawab terhadap sebarang kehilangan atau kerosakan yang dialami kerana menggunakan maklumat dalam laman ini.

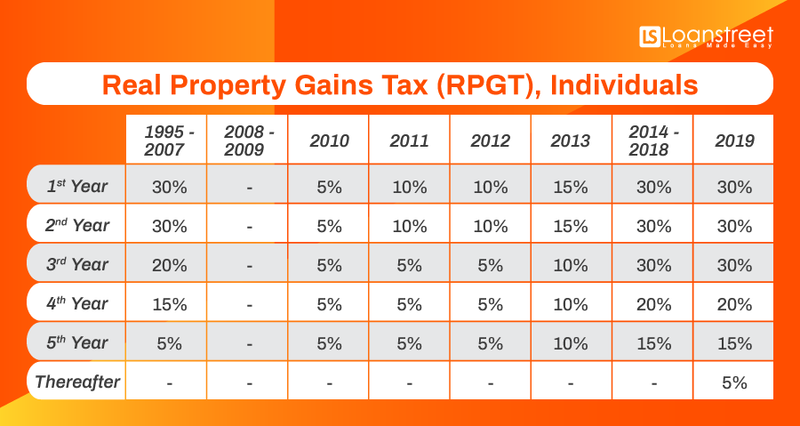

Rpgt rpgt calculation chargeable gain disposal price. In general term stamp duty will be imposed to legal commercial and financial instruments. Learn about malaysia s property stamp duty and real property gains tax rpgt in 2019.