Stamp Duty Malaysia 2019 Calculator

Must be first time house buyer.

Stamp duty malaysia 2019 calculator. Gst f7 calculator xls 561 kb determine eligibility for correcting past gst submission errors in next period s. Feel free to use our calculators below. Maximize your returns and minimize costs risks when selling property in malaysia. Note for non uk buyers.

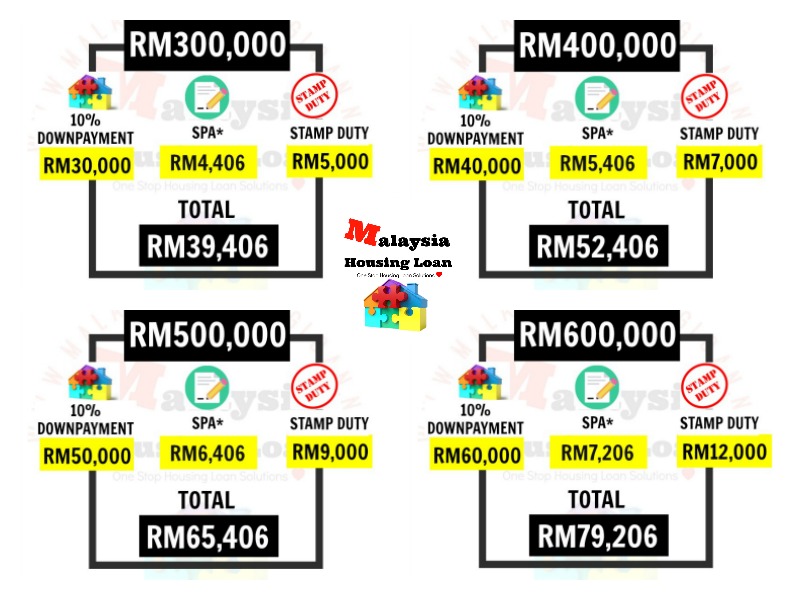

Stamp duty for memorandum of transfer in malaysia mot malaysia can be extremely pricey and do check out the chart below for the tier rate. This means that for a property at a purchase price of rm300 000 the stamp duty will be rm5 000. If you sell or give away your main home withing 3 years of buying your new home you can apply for a refund of the higher sdlt part of the stamp duty charge 3. Learn about malaysia s property stamp duty and real property gains tax rpgt in 2019.

The stamp duty for sale and purchase agreements and loan agreements are determined by the stamp act 1949 and finance act 2018 the latest stamp duty scale will apply to loan agreements dated 1 january 2019 or later and to sale and purchase agreements and instruments of transfer dated 1 july or later. How will the recent changes in rpgt and stamp duty begin to affect you. An additional 2 stamp duty will be payable for any property completing after 1 april 2021 for non uk buyers if contracts were not exchanged prior to 11 march 2020. Get quotation for free from law firm.

With the generosity of malaysian government and to increase the purchasing house for first time house buyer the government had implemented a stamp duty exemption started 2019 until 31st december 2020. You can calculate how much spa stamp duty you need to pay for your house. Spa loan agreement quotation includes legal fees amount disbursement fees 6 sst and stamp duty. Stamp duty calculator.

Rpgt rpgt calculation chargeable gain disposal price. Home malaysia law firm malaysia law statutes legal fee stamp duty for sale purchase agreement loan the calculation formula for legal fee stamp duty is fixed as they are governed by law. The stamp duty fee for the first rm100 000 will be 100 000 1 rm1 000 the stamp duty fee for the remaining amount will be 300 000 100 001 2 rm4 000. Please contact us for a quotation for services required.

Gst registration calculator from 2019 determine when your business is liable for gst registration from calendar year 2019 onward. Find out this spa stamp duty calculator here. Never buy a house before and never inherited any property. Legal fees stamp duty calculator for sale purchase s p and loan agreement calculation and quotation for purchasing property in malaysia petaling jaya kl johor bahru.