Public Mutual Epf Fund Performance

If reflected the fee would reduce the performance quoted.

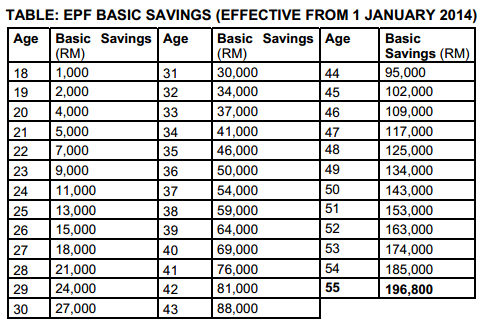

Public mutual epf fund performance. Nov 7 2013 i opened a public mutual fund account last month through a part time agent who 26000 to be able to invest in the public mutual epf investment scheme. You can get the catalog that reviews all the available funds here. The reason is because the sales charges when one invest unit trust via epf is only 3 the sales charges for investment via cash is 5 5 6. We offer a comprehensive range of products comprising conventional and shariah based unit trust and prs funds as well as financial planning services.

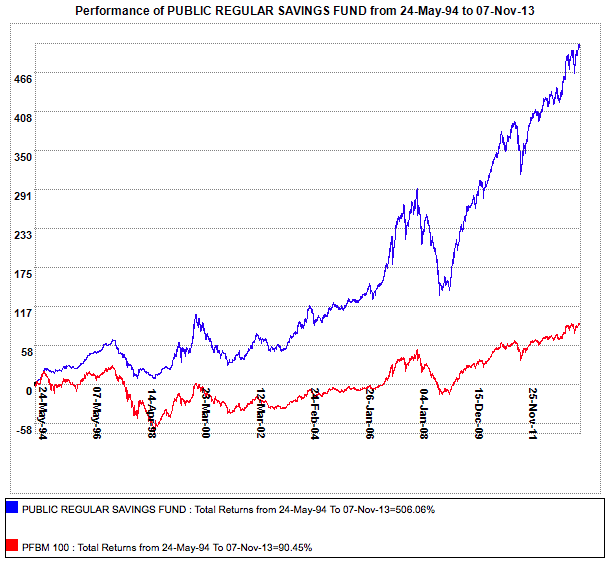

Please refer to the fund s prospectus for redemption fee information. Public mutual berhad a wholly owned subsidiary of public bank is a top private unit trust management company and leading prs provider in malaysia. Top epf performance funds from public mutual just got this information from my public mutual fund agent and i think is a good thing to share here. This is 3 years trend for public mutual funds that allowed for epf withdrawal for investment.

The taxation of mutual funds is as follows. The main reason i was attracted by the fund initially was that i could invest using my epf employee provident fund saving from account 1 if you are wondering. Most mutual funds charge 2 00 on the redemption of shares including by exchange held for less than a certain number of calendar days. I opened a public mutual fund account last month through a part time agent who works in the same company as me.

But the catch is no all the fund you can via if you choose to invest from epf. If you plan to invest into public mutual s unit trust fund i would like to recommend you to do so via epf. Performance figures reported do not reflect the deduction of this fee. Public mutual berhad a wholly owned subsidiary of public bank is a top private unit trust management company and leading prs provider in malaysia.

We offer a comprehensive range of products comprising conventional and shariah based unit trust and prs funds as well as financial planning services. However this does not apply to other mutual fund categories. Investment in a specific category of mutual funds called elss funds also gets you a tax deduction up to rs 1 5 lakh per annum under section 80c.