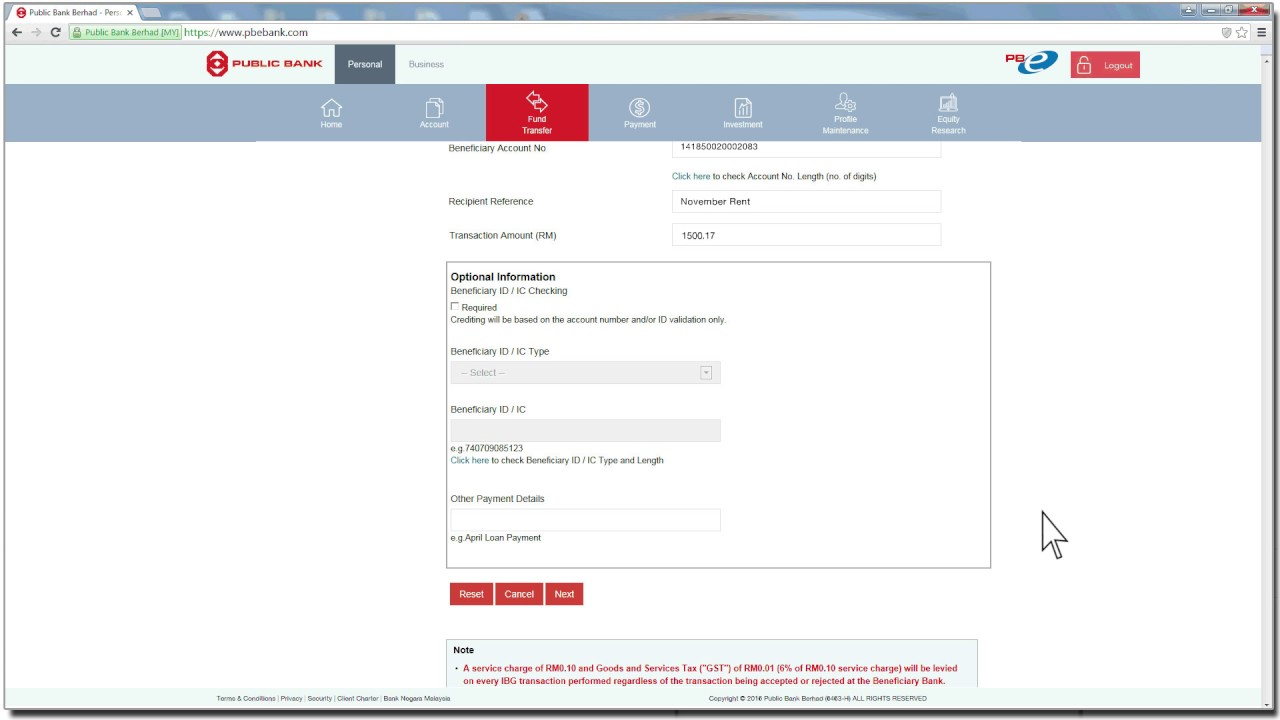

Public Bank Current Account Transfer

In c properties should be pascalcased owner balance transaction in account i would push for no public fields name in bank always expose properties rather than fields if a property should not be changed outside the class it should have no public getter.

Public bank current account transfer. Public bank a complete one stop financial portal offering a range of accounts credit cards remittance. Interest bearing current account was previously called w in current account before 21 january 2009. You are advised to. Coding points fields and properties.

Opening a public bank current account serves you a host of banking benefits. Take note that a service charge of usd1 00 or equivalent per month will be levied for request of hardcopy monthly current account statements. New accounts opened for less than. Maintains an active current account with public bank for more than 12 months.

How does public bank balance transfer work. Must not have committed any act of bankruptcy or been subject to any resolution or petition for winding up or insolvency. Imposed on business accounts only. With public bank balance transfer you have the option to service your credit card outstanding balance from 6 12 24 and up to 36 months.

Must not have committed any act of bankruptcy or been subject to any resolution or petition for winding up or insolvency. Half yearly service charge current accounts i exempted from the half yearly service charge. Under the interest bearing current account the account respective deposit interest rate s p a will be applied to corresponding range s of deposit amount tier. Rm10 00 per cheque to be collected from the payee 10.

First of all you will need a minimum deposit of rm3 000 to open a plus current account i. According to the daily closing balance daily interest will be calculated and accrued on a simple basis at such rate s p a applicable to corresponding deposit amount tier s on a 365 day annual basis. Maintains a good track record without any dishonoured cheque dcheqs offence and no frequent representation of cheques. Public bank a complete one stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers.

The above products and services are bound by relevant terms and conditions. Public bank lets you stretch the repayment up to 36 months from 1 5 upfront interest rate with its balance transfer plan. Maintains a good track record without any dishonoured cheque dcheqs offence and no frequent representation of cheques. Upon successful opening you will be issued with an atm card which also functions as a debit card where you can use to pay for your purchases.

Maintains an active current account with public bank for more than 12 months. The above mentioned interest entitlement does not apply to prestige account.