Lhdn Penalty For Late Submission

According to lembaga hasil dalam negeri lhdn the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today.

Lhdn penalty for late submission. Purpose these guidelines explain the imposition of penalties on. If the tax and penalty imposed is not paid within 60 days from the date the penalty is imposed a further penalty of 5 will be imposed on the amount still owing. 150 tarikh kemaskini. For example if your total taxable amount is just rm500 now you have to pay rm1 500 because of the 300 penalty.

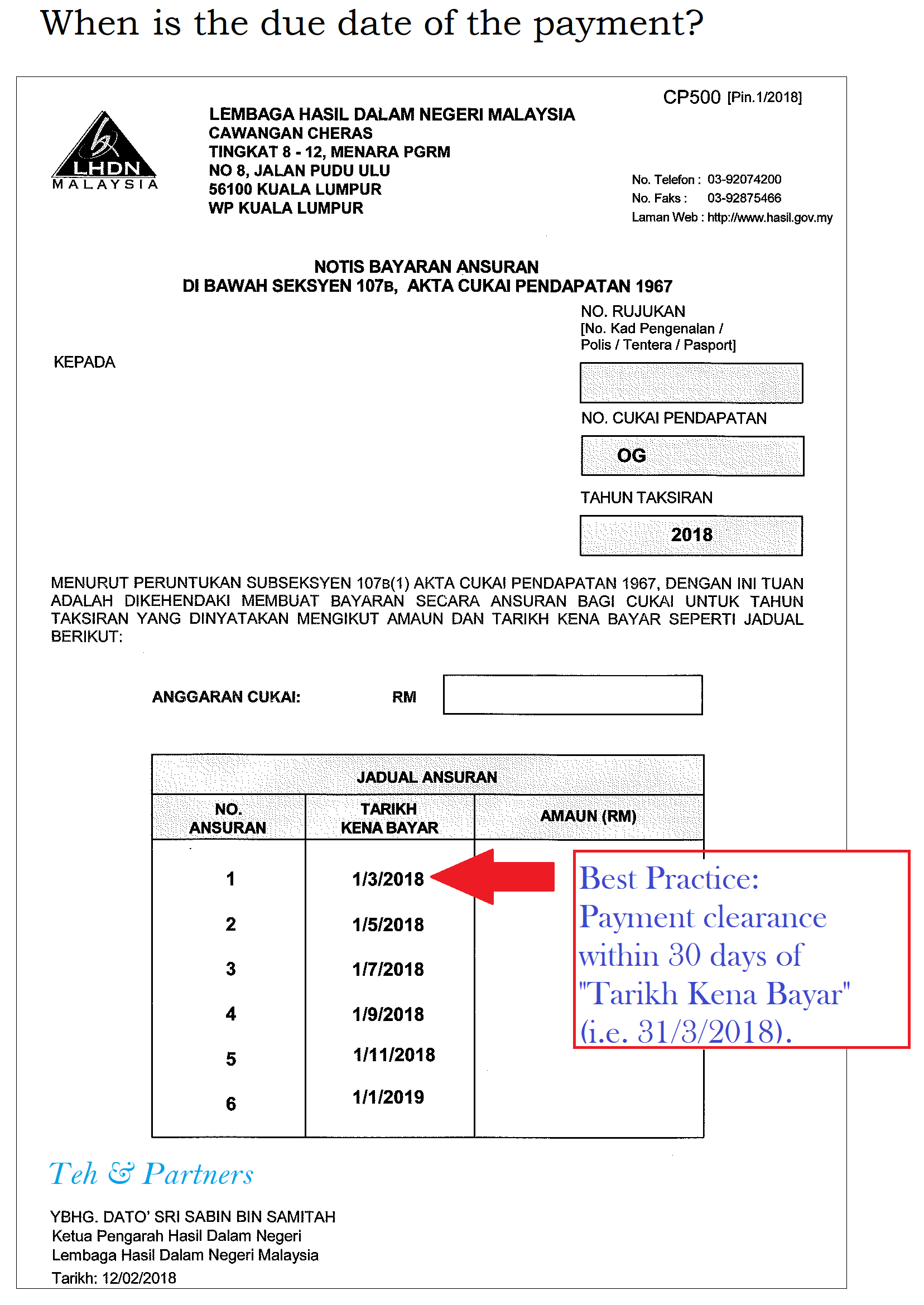

For individual with employment no business income the dateline is 30th april while individual with business income the dateline is 30th june. Posted on september 4 2020 september 4 2020 by admin. Tax filing deadline extension for year 2020 updated 28 april 2020 for more information please refer to lhdn rf filing programme year 2020 amendment 3 2020 2020. Failure to remit the instalments on a timely basis will result in an automatic penalty of 10 being imposed on the unpaid amount.

Short answer sh will happen. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Penalty for late payment. That s a lot of money people.

The following table is the summary of the offences fines penalties for each offence. Thus the new deadline for filing your income tax returns in malaysia via e filing is 30 june 2020 for resident individuals who do not carry on a business and 30 august 2020 for resident individuals who carry on a. A late payment penalty of 10 will be imposed on the balance of tax not paid after 30th april following the year of assessment. The period prescribed under the income tax act 1967 acp 1967 petroleum.

Long answer if caught by the lhdn s auditor you ll face a penalty ranging from 80 to 300 of the taxable amount. Penalty as per income tax act ita 1967 any person who committed for an offence will be fine either through penalty of imprisonment or both depending on severity or the number of offences. Taxpayers who are late or fail to submit a return form in. Ree 3 months grace period from the due date of submission is allowed for those with accounting period ending 1 september 2019 until 31 december 2019.