Epf Withdrawal For Housing Loan Settlement

Declaration form from member amount eligible.

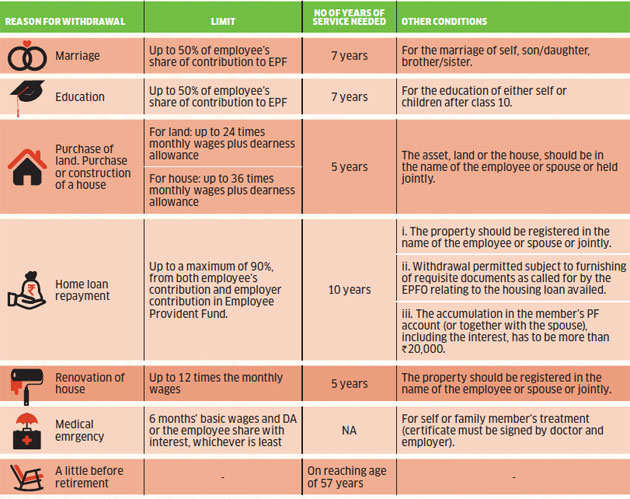

Epf withdrawal for housing loan settlement. This scheme is an addition to the above scheme withdrawal to reduce redeem housing loan and allows you to set up a standing instruction for money from account 2 to be directly paid to the bank or. Members can withdraw the existing amount to be used in repaying an already prevailing house loan. Epf withdrawal for repay housing loan modifying existing house purchasing sponsored links. 2 buying a home as an individual you may withdraw the difference between the price of the home and the loan amount plus 10 of the home purchase price or all the money in account 2 whichever is lower and not less than rm500.

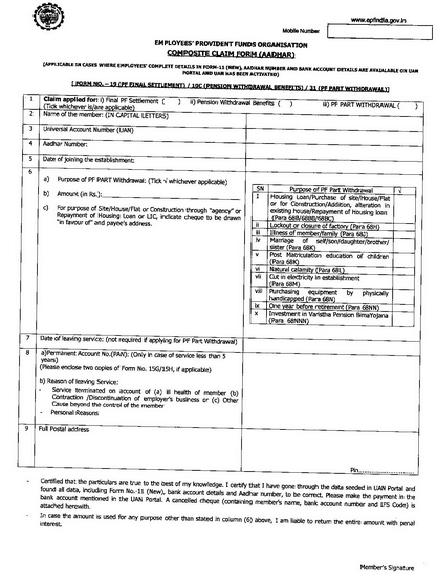

A member should obtain 2 housing loan application forms from the nearest labour office or download from the website and send them back duly filled to the same office. Process to withdraw the epf amount for repayment of home loan. To facilitate epf members in preparing for a comfortable retirement the epf allows you to make a partial or full withdrawal from your savings to meet the specific retirement related needs that are in line with the epf s current policies. Contributors who previously found it monetarily tight to buy a property can now consider doing so with this new withdrawal scheme.

12 of the employee s basic salary and dearness allowance da is contributed by the employee and employer towards the scheme every month. If several loan providers are involved the loan redemption letter will be compared against the latest balance to determine the eligible withdrawal amount. The labour department will check the forms and forward from no 02 based on the information provided in the application to the epf department. The full list of t cs plus the necessary supporting documents can be found at kwsp 9c ahl d8 withdrawal form of kwsp s website.

However there certain procedures and criteria that one is required to carefully follow. In the case of re financing the loan balance accounted for is based on the original housing loan payment from the first loan provider or the latest loan balance whichever is lower. The commissioner issues a certificate specifying the monthly contribution of the last 3 months. The maximum you may withdraw under a zero down home loan is 10 of the home price to help pay for entry costs and other fees.

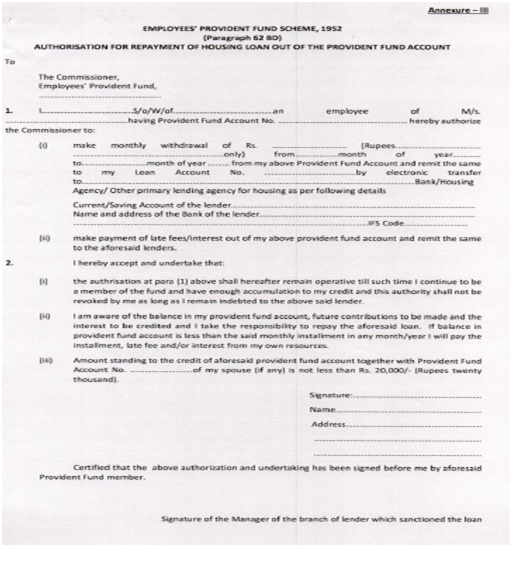

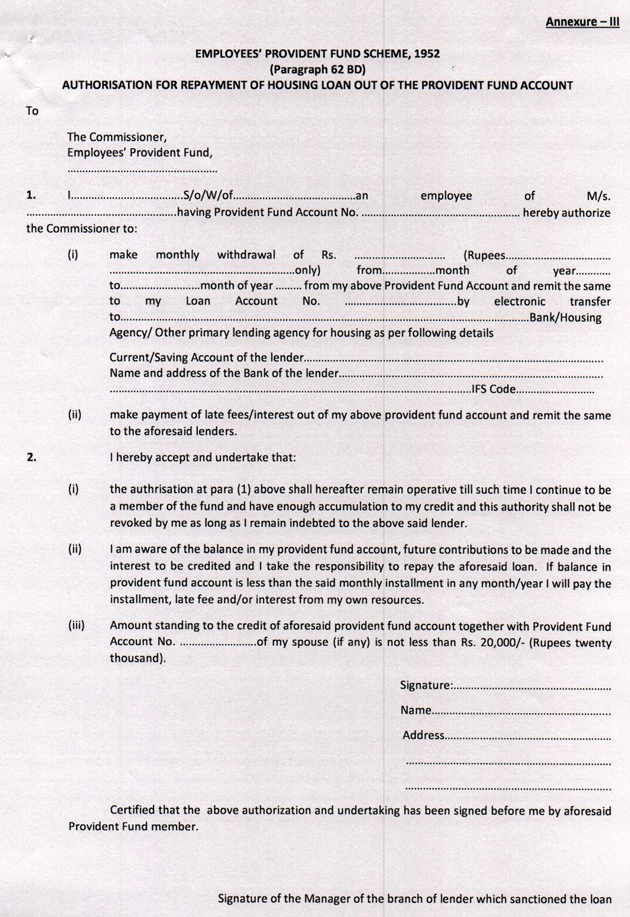

Withdrawal to pay down housing loan monthly installment. The employee s provident fund epf scheme allows an individual save towards retirement. Epf amount can be also withdrawn for repaying the existing housing loan taken by the member. Follow these simple steps to utilize your epf for repaying your home loan as per the updated epf withdrawal rules a pf member can apply for the loan through the housing society to the epf commissioner in the format prescribed in annexure 1.

The move to allow withdrawal of epf to finance housing loans is a new one which would benefit about five million active epf contributors.