Epf Employer Contribution Rate 2019

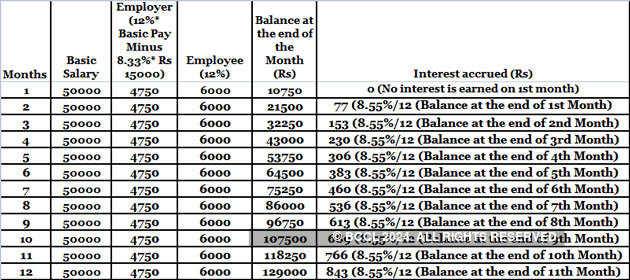

When calculating interest the interest applicable per month is 8 50 12 0 7083.

Epf employer contribution rate 2019. Cpf contribution and allocation rates. The interest rate for 2019 2020 is 8 50. 2 3 67 of employer s share in epf of 20000 inr 734. Cpf contribution and allocation rates p cpf contributions are payable at the prevailing cpf contribution rates for your employees who are singapore citizens and singapore permanent residents spr p.

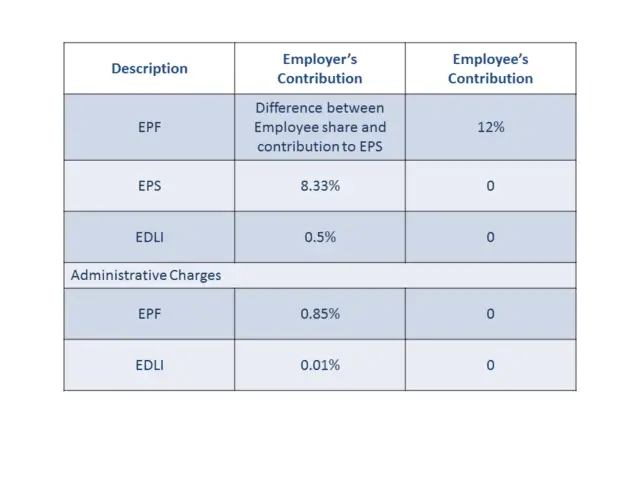

The epf receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non pensionable public sectors as well as voluntary contributions by those in the informal sector. To pay contribution on higher wages a joint request from employee and employer is required para 26 6 of epf scheme. Employer s contribution towards epf employee s contribution employer s contribution towards eps 550. Employers are required to remit epf contributions based on this schedule.

1 12 of employees share in epf i e. Pf contribution rate of employee and employer was defined as per epf act and mandatory to follow. 15000 the employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate. Let assume the basic salary of a person is inr 20 000.

This is maintained by the employees provident fund organization of india. So below is the breakup of epf contribution of a salaried person will look like. Now let s have a look at an example of epf contribution. 12 of 20000 inr 2 400.

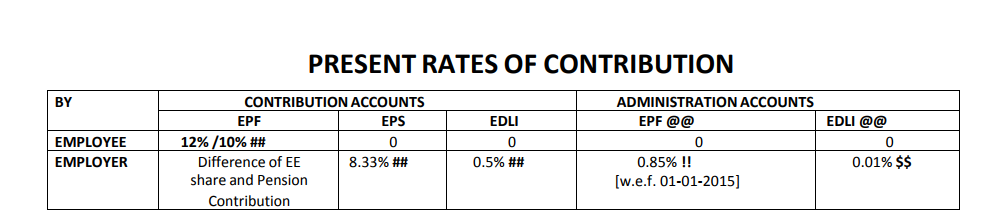

Any company over 20 employees is required by law to register with epfo. The move to reduce the statutory contribution rates follows the government s proposal during the tabling of budget 2019 on nov 2 2018 to help increase the take home pay for employees who continue to work after reaching age 60. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download. Total epf contribution every month 1 800 550 2 350.

Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. This is a retirement benefit scheme that is available to the salaried individuals.