Epf Contribution Table For Age Above 60 2018

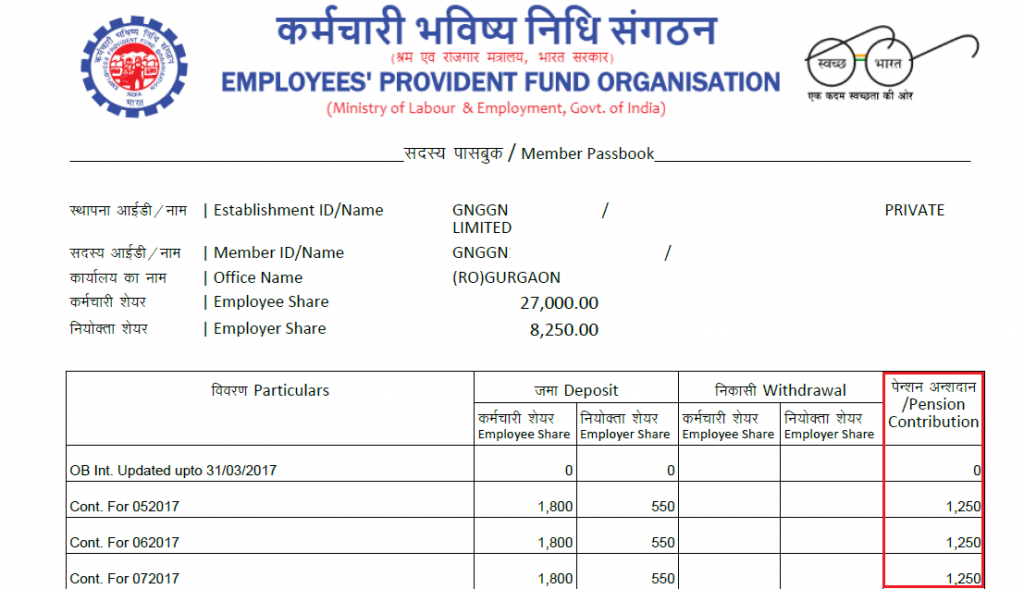

Therefore the contribution month is february 2018 and it has to be paid either before or on 15 february 2018.

Epf contribution table for age above 60 2018. Replied by kap chew on topic socso contribution above age 60 please go to employee management edit salary statutory details then change socso category to employment injury only. The new minimum statutory rates proposed in budget 2019 are effective this month for the. Kuala lumpur jan 7. Effective from january 2018 the employees monthly statutory contribution rates will be reverted from the current 8 to the original 11 for employees below the age of 60 and from 4 to 5 5 for those aged 60 and above.

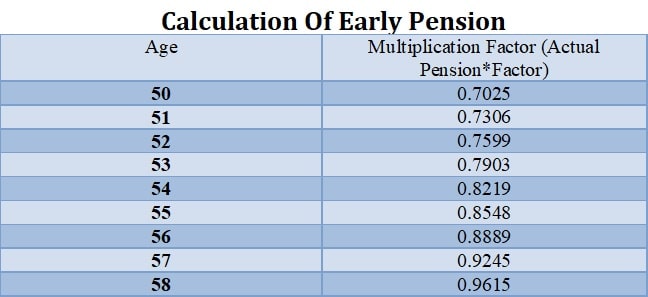

50 years below above 50 to 55 years above 55 to 60 years above 60 to 65 years above 65 years. The age groups are. Change of age group the cpf contribution rate changes as an employee moves to the next age group. Please log in or create an account to join the conversation.

At the same time the employees share of minimum contribution rate has been reduced to 0 down from the previous 5 5 this was announced by the epf also known as kwsp kumpulan wang simpanan pekerja on 7. Workers above 60 to 65 receive a 16 5 contribution rate with employers. Meanwhile the employees share of contribution for this age group is set at zero the epf said in a statement today. The minimum statutory contribution by employers to malaysia s employees provident fund epf for employees aged above 60 will be reduced to 4 per month down from the previous 6.

For the exact contribution amount refer to the contribution schedule jadual or head over to the epf contribution website. The employer needs to pay both the employees and the employer s share to the epf. Instead the statutory contribution rate for employee s share will revert to the original 11 for members below the age of 60 and 5 5 for those aged 60 and above. But workers above 55 to 60 see a cpf contribution rate of 26 per cent of wages with employers contributing 13 per cent.

The employees provident fund epf announced that the minimum employers share of epf statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to 4 per month while the employees share of contribution rate will be 0. The new rates will apply from the first day of the month after the employee turns 50 55 60 or 65. If your employer fails to deduct your salary for epf contributions at the time your salary is paid your employer cannot recover the contributions from you after a period of six months. Employers may deduct the employee s share from their salary.

Employers are required to ensure the right.