Epf Contribution Rate 2019 20 Pdf

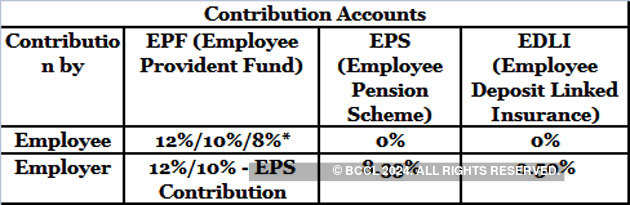

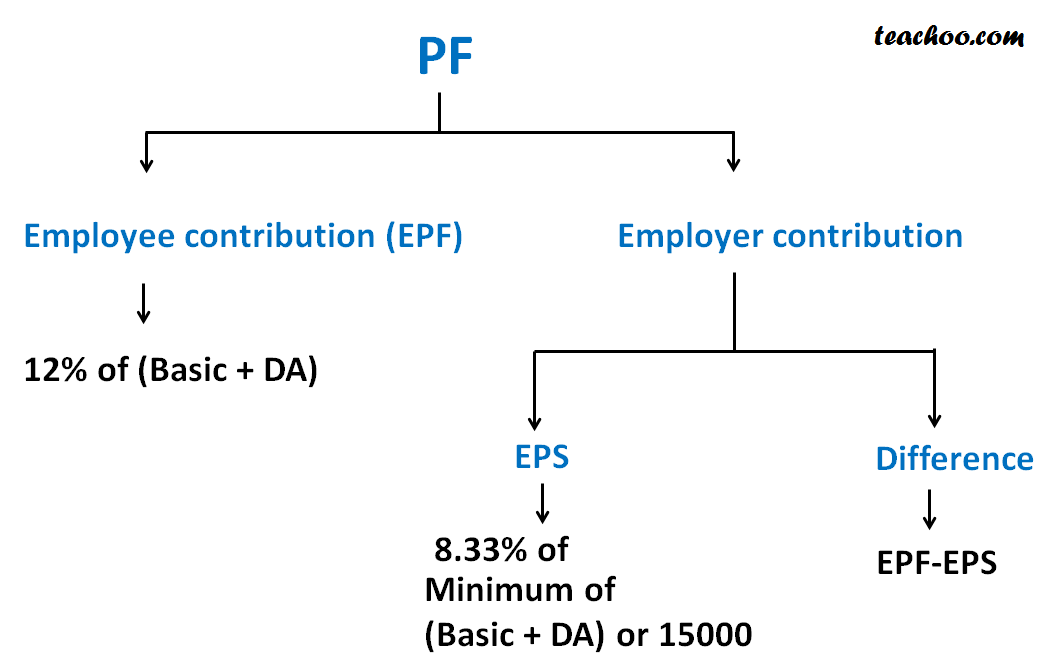

So below is the breakup of epf contribution of a salaried person will look like.

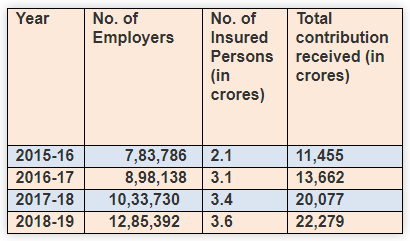

Epf contribution rate 2019 20 pdf. Notification dated 9th april 1997 was issued enhancing provident fund contribution rate from 8 33 to 10. For 2019 20 the interest rate is 8 50 which is reduced from the earlier 8 65 per cent. The epf receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non pensionable public sectors as well as voluntary contributions by those in the informal sector. 8 33 of 20000 inr 1 666 employer s epf contribution is epf eps.

With this 172 categories of industries establishments out of 177 categories notified were to pay provident fund contribution 10 w e f. Epfo invites request for proposals for appointment of consultant the epfigms services is available in umang platform inviting applications from retired officers for empanelment as inquiry officer in epfo epfo won the skoch gold award 2020 in the digital governance category epfo helpdesk is operational from 7 00 am to 9 00 pm on all days. If the employer pays a higher amount the employer does not have to pay a higher rate as well. 1 12 of employees share in epf i e.

For more information check out related articles uan registration uan login pf balance check epf claim status. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. 22 09 1997 onwards 10 enhanced rate 12. If the maximum wage ceiling is rs 15 000 contributions are mandatory.

3 8 33 of employer s share in eps i e. Employee contribution epf 12 20000 2400 employer contribution eps 8 33 15000 1250 difference 2400 1250 1150 total employer pf 1250 1150 2400 note even if pf is calculated at higher amount for eps we will take 15000 limit only remaining amount wil go to difference. Contribution for epf. 2 3 67 of employer s share in epf of 20000 inr 734.

Fundamental duties of the citizens of india vaw 2020. 12 of 20000 inr 2 400. Epf is a retirement benefits scheme under the employees provident fund and miscellaneous act 1952 where an employee has to pay a certain contribution towards the scheme and an equal contribution is paid by the employer as well on a month on month basis. The epfo has decided to provide 8 5 per cent interest rate on epf deposits for 2019 20 in the central board of trustees cbt meeting held today states gangwar.