Epf Contribution Rate 2019 20 In Hindi

The epf receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non pensionable public sectors as well as voluntary contributions by those in the informal sector.

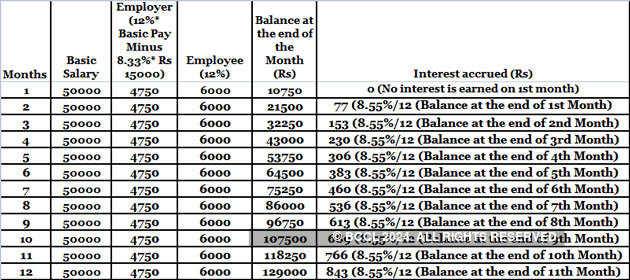

Epf contribution rate 2019 20 in hindi. An employer has to match the employee s contribution of 12 per cent of employees basic pay however the employer is not obliged to match employee s higher contribution towards vpf. A 31011 1 2020 exam 14 dated 20 07 2020 256 5kb 41. The pf interest rate for the financial year 2017 18 is 8. Revised esi contribution rates employer 3 25 employee 0 75.

121 e dated the 15th february 2019 as. Settlement of death claims on priority basis in events of industrial accidents etc. Well epfhindi in me apka swagat hai ajj hum bat karege epf interest rate ke bare me. Edli 3 39 som 2020 246 dated 17 07 2020 243 8kb 40.

Yeh epf interest rate epf ki pichle 3 saalo me peheli bar badhaya gaya hai. Employees provident fund organisation epfo india s retirement fund manager ne epf par diye jane wale epf interest rate ko 8 55 se badha kar 8 65 kar diya hai yaani ki ab employee or employer ke contribution par 8 65 interest kia jayega wahi jaha pehele 8 55 kia jata tha. 423 e whereas a draft containing certain rules further to amend the employees state insurance central rules 1950 were published in the gazette of india extraordinary part ii section 3 sub section i vide number g s r. The interest received is directly transferred to the account of the employees provident fund and is computed as per the rate pre decided by the government of india and central board of.

Such contribution above the mandatory 12 per cent is considered as a voluntary provident fund vpf. 09 04 1997 to 21 09 1997 8 33 enhanced rate 10 notification dated 9th april 1997 was issued enhancing provident fund contribution rate from 8 33 to 10. The interest is applicable to the accumulated fund in the pf account is 100 tax exempted. With this 172 categories of.

As on 31st march 1991 the enhanced rate of 10 per cent was applicable to the establishments employing 50 or more persons. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. For 2019 20 the interest rate is 8 50 which is reduced from the earlier 8 65 per cent. The contributions towards vpf may be modified annually by the employe.

The epfo has decided to provide 8 5 per cent interest rate on epf deposits for 2019 20 in the central board of trustees cbt meeting held today states gangwar.