Epf Contribution Rate 2019 20 For Employer

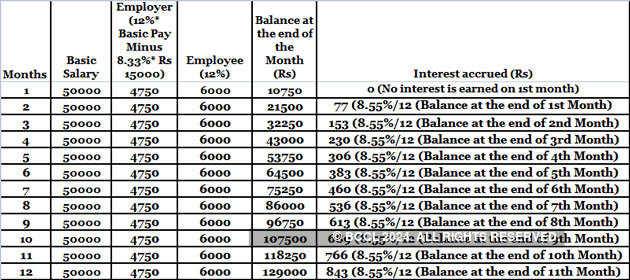

Employers contribution towards epf employee contribution employers contribution towards employee pension scheme rs550 total epf contribution per month rs 1 800 rs 550 rs2 350 the pf interest rate for 2017 2018 is 8 55.

Epf contribution rate 2019 20 for employer. 12 of 20000 inr 2 400. Let assume the basic salary of a person is inr 20 000. The pf interest rate 2019 20 is 8 5 per cent while for 2018 19 it was declared at 8 65 per cent up from 8 55 per cent for the fy 2017 18. For more information check out related articles uan registration uan login pf balance check epf claim status.

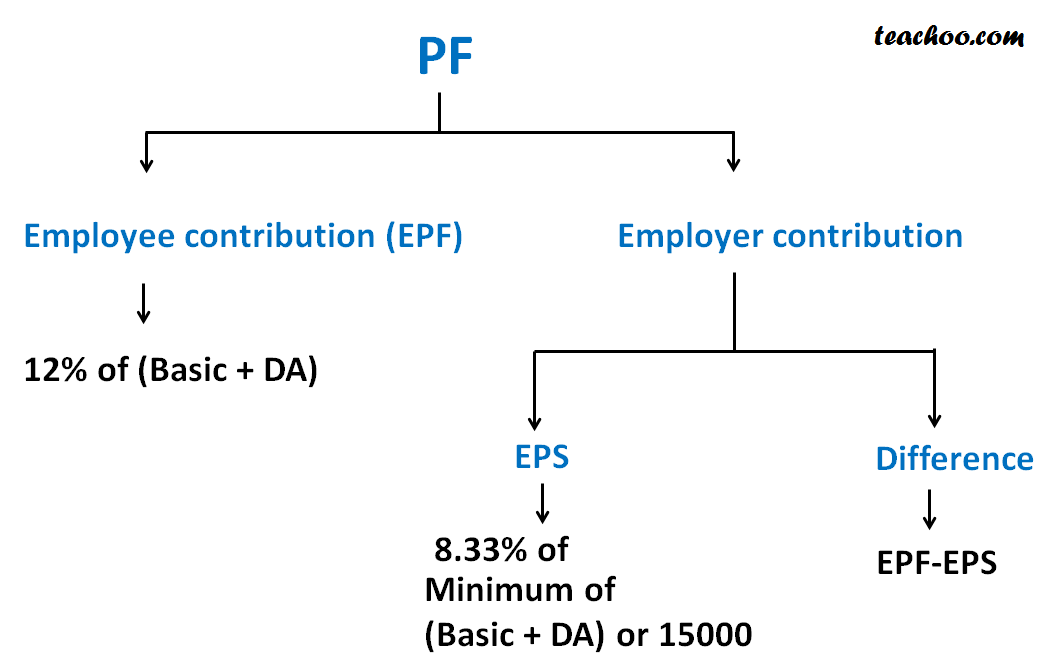

Contribution for epf. Employee contribution epf 12 20000 2400 employer contribution eps 8 33 15000 1250 difference 2400 1250 1150 total employer pf 1250 1150 2400 note even if pf is calculated at higher amount for eps we will take 15000 limit only remaining amount wil go to difference. Epf interest rate 2019 20 how to calculate interest on epf. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule.

1 12 of employees share in epf i e. Under epf the contributions are payable on maximum wage ceiling of rs. 15000 the employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate. Cpf contribution and allocation rates p cpf contributions are payable at the prevailing cpf contribution rates for your employees who are singapore citizens and singapore permanent residents spr p.

The epf receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non pensionable public sectors as well as voluntary contributions by those in the informal sector. So below is the breakup of epf contribution of a salaried person will look like. Now let s have a look at an example of epf contribution. If the employer pays a higher amount the employer does not have to pay a higher rate as well.

If the maximum wage ceiling is rs 15 000 contributions are mandatory. To pay contribution on higher wages a joint request from employee and employer is required para 26 6 of epf scheme.