Epf Contribution Rate 2019 20 Circular

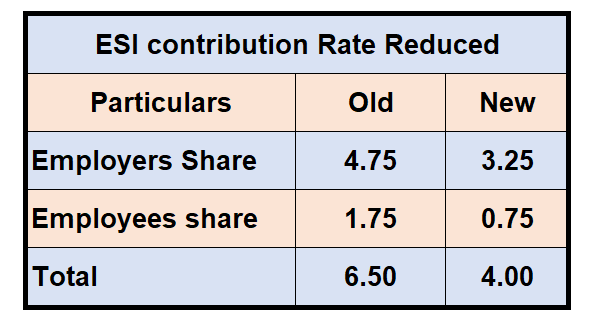

An overview of announcement by honorable finance minister nirmala sitharaman on wednesday 13 05 2020 regarding epf contribution by which epf contribution was reduced for employers and employees for 3 months to 10 from 12 for all establishments covered by epfo for next 3 months i e.

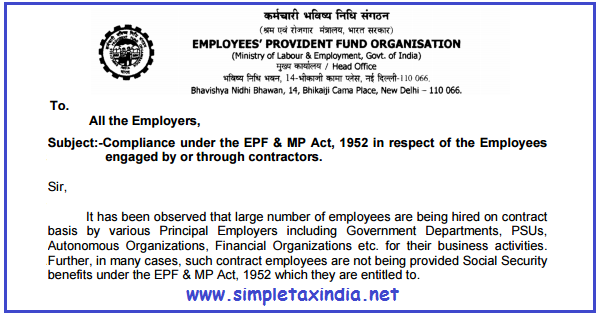

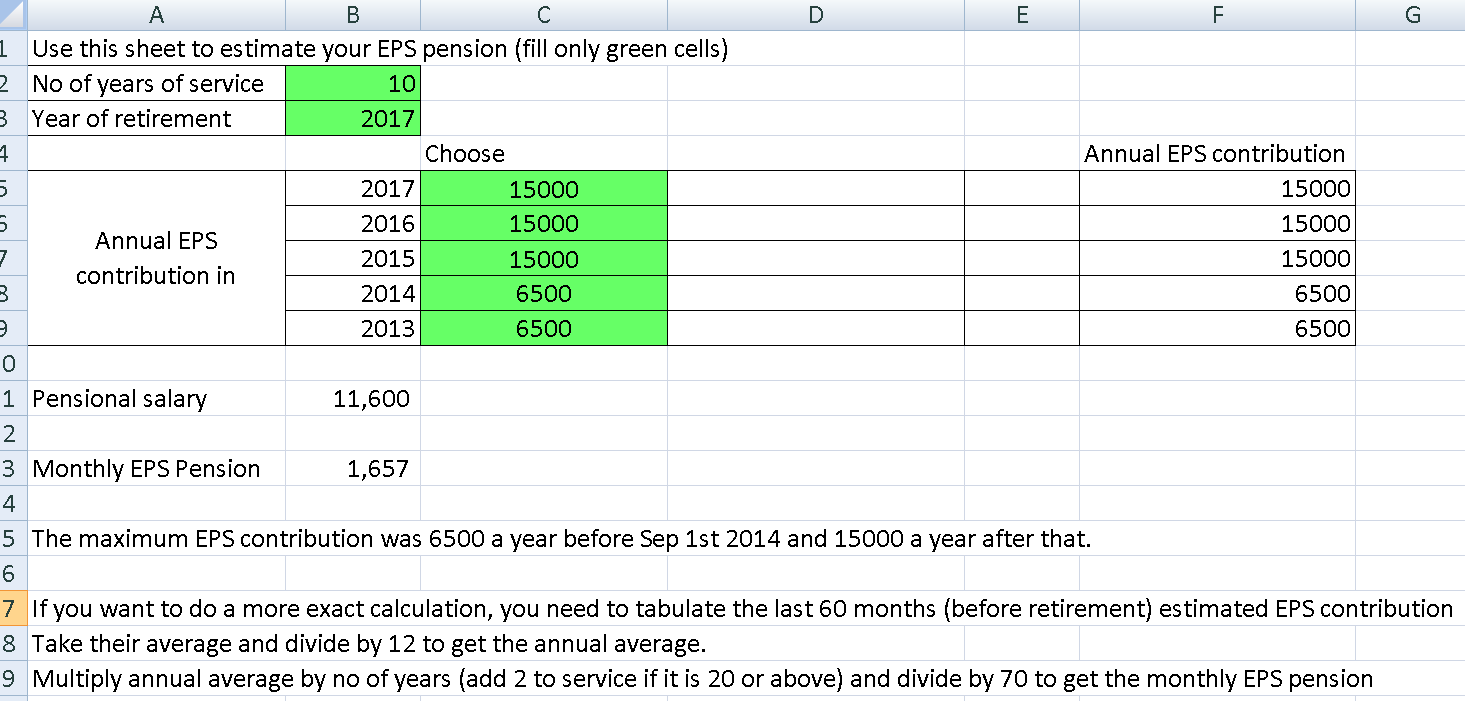

Epf contribution rate 2019 20 circular. The epf receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non pensionable public sectors as well as voluntary contributions by those in the informal sector. The epf mp act 1952 was enacted by parliament and came into force with effect from 4th march 1952. The epfo has decided to provide 8 5 per cent interest rate on epf deposits for 2019 20 in the central board of trustees cbt meeting held today states gangwar. 2 3 67 of employer s share in epf of 20000 inr 734.

Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. 3 8 33 of employer s share in eps i e. 8 33 of 20000 inr 1 666 employer s epf contribution is epf eps. With this 172 categories of.

Employees provident fund contribution rate. So below is the breakup of epf contribution of a salaried person will look like. Fundamental duties of the citizens of india vaw 2020. 1 12 of employees share in epf i e.

Employers are required to remit epf contributions based on this schedule. For 2019 20 the interest rate is 8 50 which is reduced from the earlier 8 65 per cent. Union finance minister nirmala sitharaman on 13 05 2020 announced the statutory. May 20 june 20 july 20.

12 of 20000 inr 2 400. As on 31st march 1991 the enhanced rate of 10 per cent was applicable to the establishments employing 50 or more persons. 09 04 1997 to 21 09 1997 8 33 enhanced rate 10 notification dated 9th april 1997 was issued enhancing provident fund contribution rate from 8 33 to 10.