Current Issues Of Taxation In Malaysia

In such case you may apply for credit relief under the ita 1967.

Current issues of taxation in malaysia. Green technology educational services. Expatriates working in malaysia for more than 60 days but less than 182 days are considered non tax residents and are subject to a tax rate of 30 percent. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. I am a non resident individual.

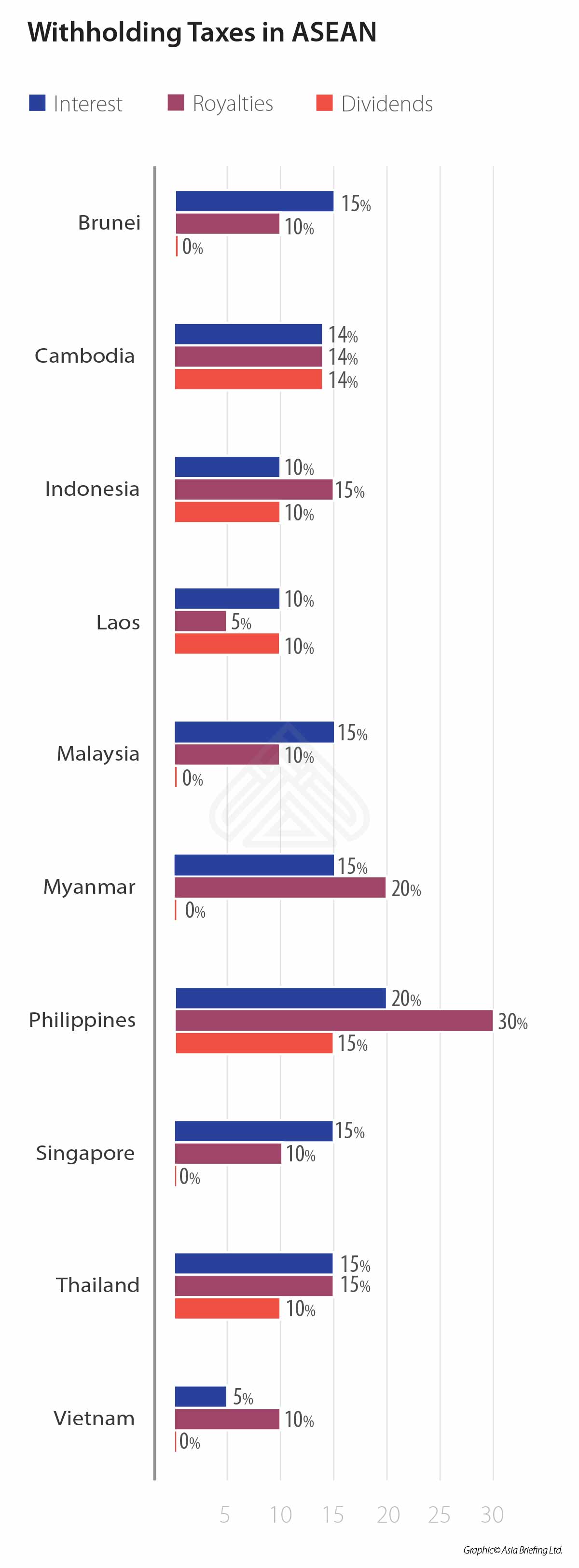

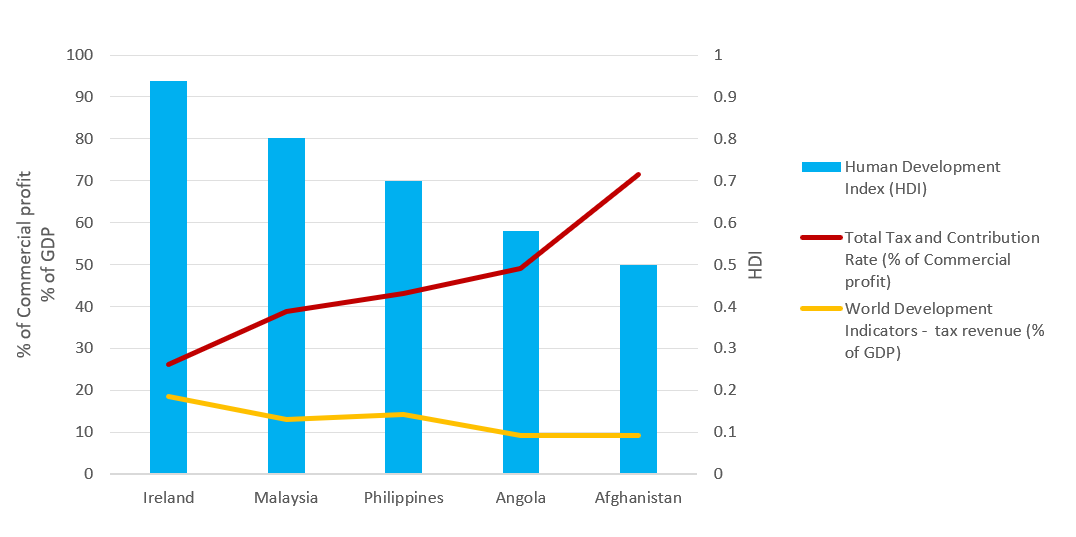

No other taxes are imposed on income from petroleum operations. Resident companies are taxed at the rate of 24 while those with paid up capital of rm2 5 million or less are taxed 18 for their first rm500 000 and 24 for earnings in exces of rm500 000. All tax residents who are subject to. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income.

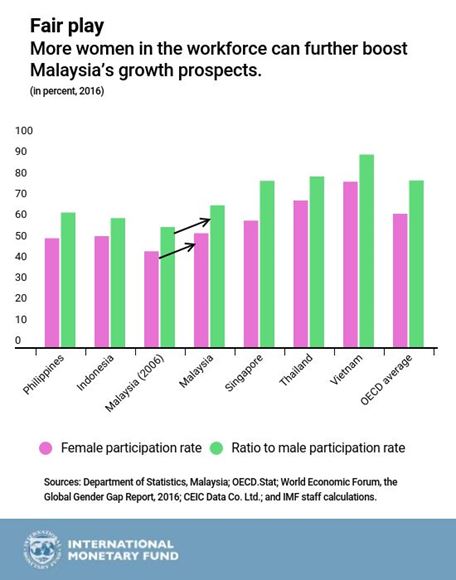

Malaysia has faced significant issues before and pundits who predicted doom and gloom were proven wrong. If you own a business that is a tax resident company in malaysia meaning that its management and control are exercised in malaysia then you will be liable to pay corporate income tax. Like many other jurisdictions malaysia has its own taxation system. Malaysia taxation and investment 2018 updated april 2018 3 principal hubs the government has issued detailed guidelines including the revised guidelines for principal hubs dated 7 july 2017 for tax incentives to promote the establishment of principal hubs in malaysia.

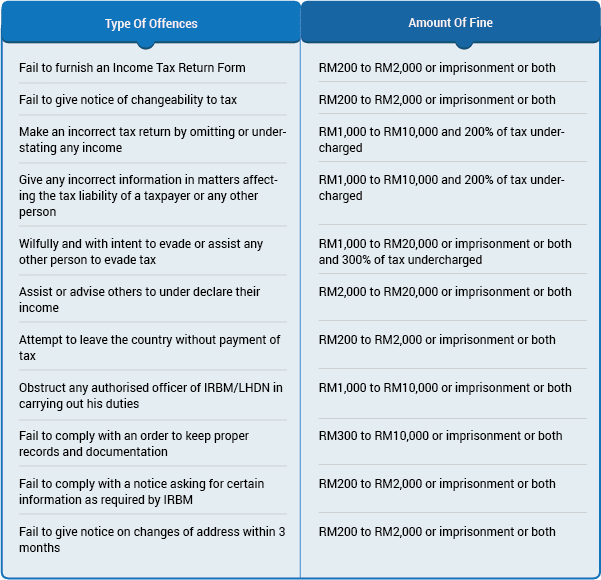

If you are in a state that has no tax treaty with malaysia you might be subject to taxation. The inland revenue board of malaysia which is the country s responsible institute for taxation provides very clearly represented and detailed information on all tax issues. These proposals will not become law until their enactment and may be amended in the course of their passage through. Income tax declaration.

Malaysia s taxes are assessed on a current year basis and are under the self assessment system for all taxpayers. If you are in a state that has a tax treaty with malaysia you will not be taxable if you are present for less than 183 days. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices.

Malaysia adopts a territorial principle of taxation meaning only incomes which are earned in malaysia are taxable. All income accrued in derived from or remitted to malaysia is liable to tax. There you will find a list on tax deduction cases the income tax scale for residents and for non residents.