Corporate Income Tax Malaysia

Income derived from sources outside malaysia and remitted by a resident company is exempted from tax.

Corporate income tax malaysia. Corporate income tax cit rates. Although tax rates may vary based on yearly budget announcements corporate income tax must be submitted and filed on a yearly basis similar to an individual s personal income tax. The proportion of interest expense will be allowed against the non business income. This tax is imposed on income that is derived from or accruing in the country both in the case of resident and non resident legal entities.

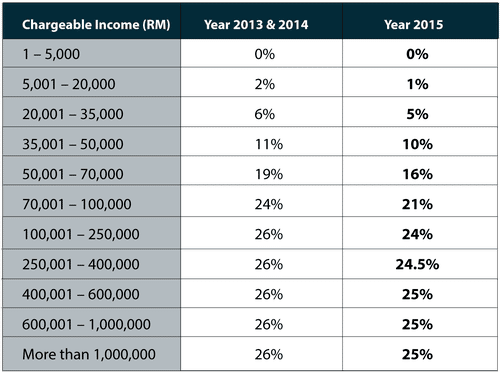

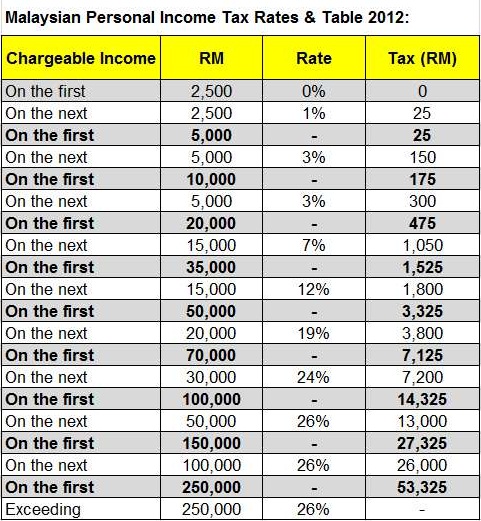

Corporate income tax cit due dates. Territorial basis of taxation. Calculations rm rate tax rm 0 5 000. On the first 5 000 next 15 000.

On the first 2 500. This page provides malaysia corporate tax rate actual values historical data forecast chart statistics economic calendar and news. Malaysia corporate deductions last reviewed 01 july 2020. A company whether resident or not is assessable on income accrued in or derived from malaysia.

The malaysia corporate tax rate has a standard rate as well as a smaller one applicable under certain conditions to small and medium resident companies. The corporate tax rate in malaysia stands at 24 percent. Malaysia corporate income tax rate. Corporate taxes on corporate income last reviewed 01 july 2020 for both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia.

Management and control is normally considered to be exercised at the place where the directors meetings concerning management and control of the company are held. Malaysia adopts a territorial system of income taxation. A corporate tax rate of 17 to 24 is imposed upon resident and non resident companies on taxable income that is sourced from or obtained in malaysia. Corporate income tax residence status.

Isnin hingga jumaat 9 00 am hingga 5 00 pm. Malaysia adopts a territorial system of income taxation. Hasil care line 03 8911 1000 603 8911 1100 luar negara waktu operasi. A company is tax resident in malaysia if its management and control is exercised in malaysia.