Corporate Income Tax Malaysia 2020

Keep up to date on significant tax developments around the globe with ey s global tax alert library here.

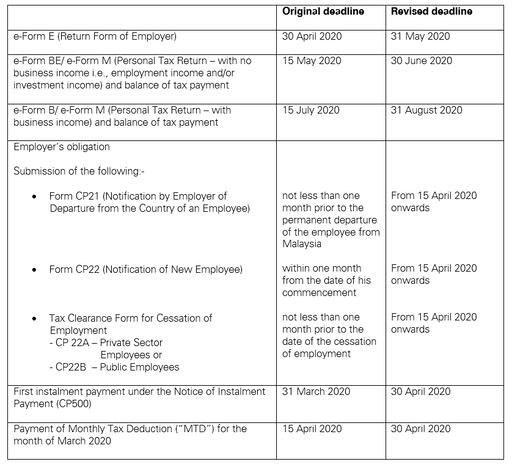

Corporate income tax malaysia 2020. Corporate income tax or corporate tax is a direct tax that is paid to the government via irbm lhdn it is governed under the income tax act 1967. This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. In budget 2020. The content is straightforward.

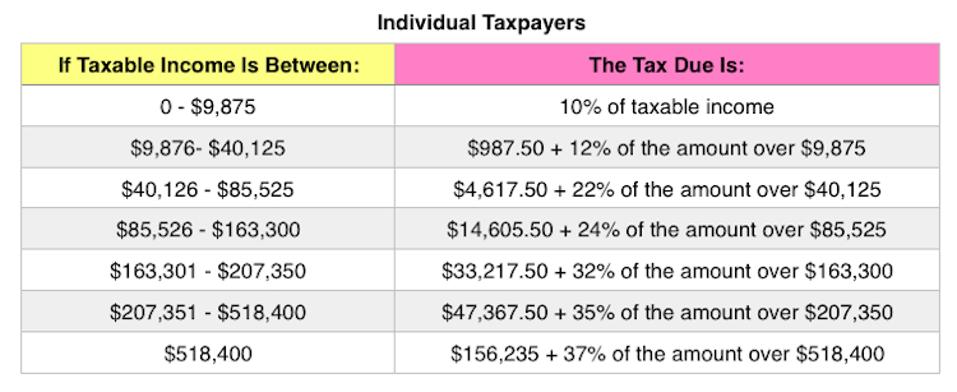

Corporate taxes on corporate income last reviewed 01 july 2020 for both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia. Ya 2020 are taxed at the following scale rates. Corporate tax rate in malaysia averaged 26 21 percent from 1997 until 2020 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. A corporate tax rate of 17 to 24 is imposed upon resident and non resident companies on taxable income that is sourced from or obtained in malaysia.

On the first 2 500. The content is current on 1 january 2020 with exceptions noted. Chapter by chapter from albania to zimbabwe we summarize corporate tax systems in more than 160 jurisdictions. This page provides malaysia corporate tax rate actual values historical data forecast chart statistics economic calendar and news.

A tax resident person including a partnership carrying on shipping business using malaysian ships is given full income tax exemption on statutory income determined on a per ship basis. On the first 5 000 next 15 000. This exemption is available until year of assessment 2020. Chargeable income will be tax at 17 with effective from ya 2019 and the chargeable income above rm500 000 will be tax at 24.

The corporate tax rate in malaysia stands at 24 percent. These proposals will not become law until their enactment and may be amended in the course of their passage through. Resident companies are taxed at the rate of 24 while those with paid up capital of rm2 5 million or less and with annual sales of not more than rm50 million w e f. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019.

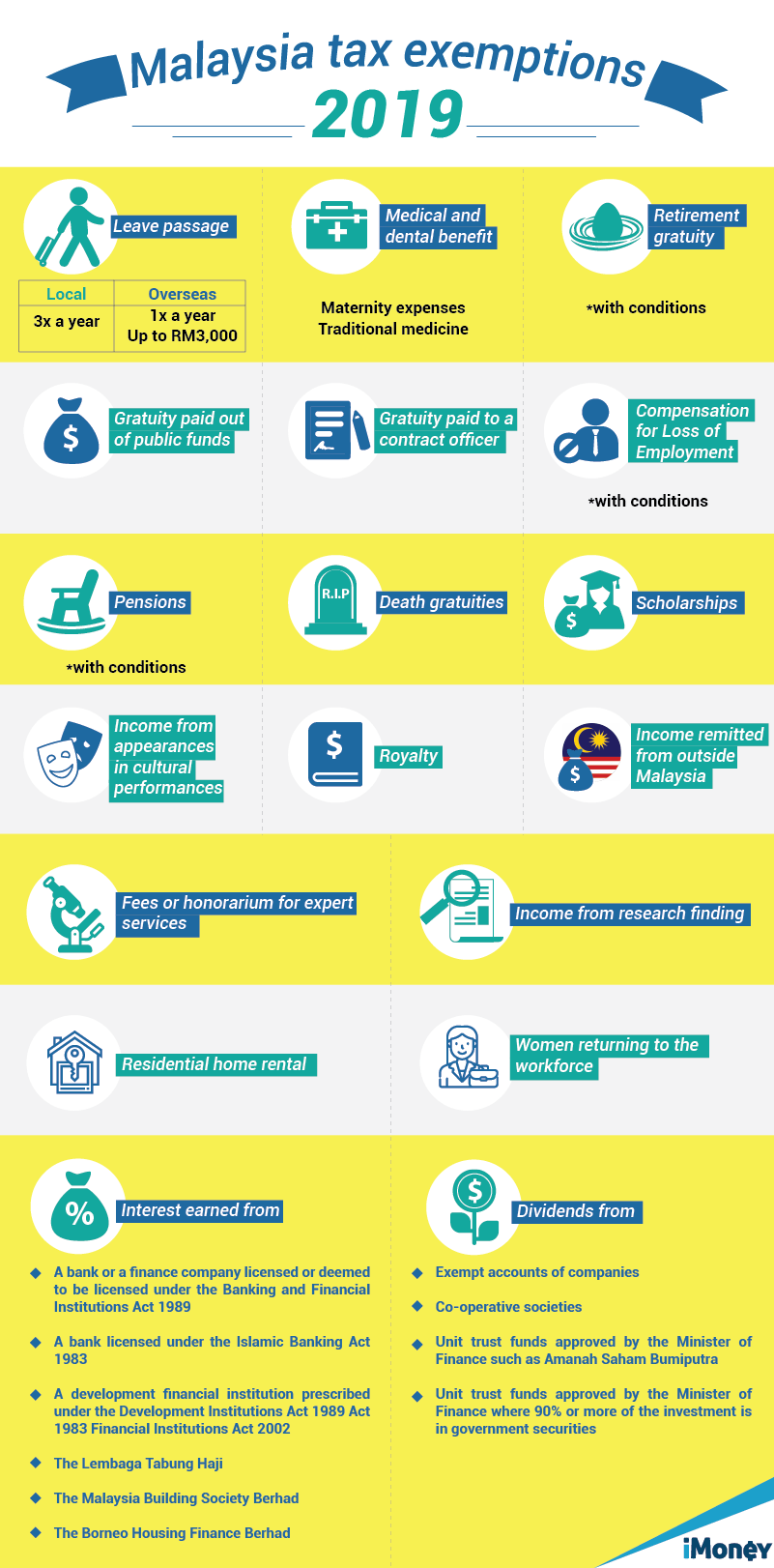

Income derived from sources outside malaysia and remitted by a resident company is exempted from tax except in the case of the banking and insurance business and sea and air transport undertakings.