Bank Rakyat Housing Loan Interest Rate 2020

Fixed rate bank loan packages come with higher interest rates than floating rates packages.

Bank rakyat housing loan interest rate 2020. Sibor sor and the other unfamiliar looking names all belong to the category of floating rates. Hatton national bank shanthi home loans. Alliance bank updated on. Get interest rates from as low as 4 15 on your housing loan.

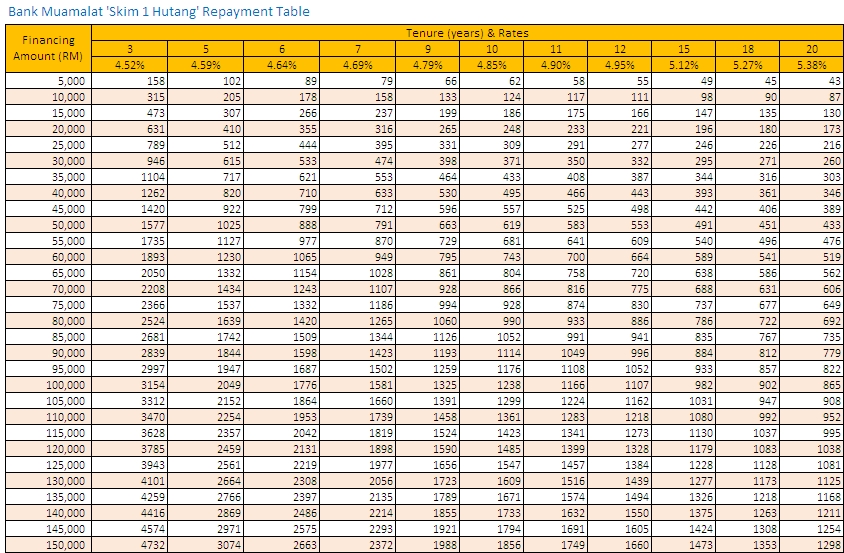

You can always pay in excess of your fixed monthly repayments but it will only count as an advanced payment since this bank rakyat housing loan is not a flexi loan. Base rate br 2 60 effective on 15 july 2020 onwards profit rate p a. Compare housing loans in malaysia 2020. Bank 1 month 3 months 6 months 12 months.

29 may 2019 2 95. Fixed rate and floating rates home loan. Besides the variety repayment alternatives via this bank rakyat housing loan you are protected against a hike in rates as it is based on a capped floating profit rate of 10 6. To be eligible for a home loan an individual should earn a regular monthly income of lkr 30 000 or above and the income should be sufficient to meet the monthly loan commitment as well as other commitments and living expenses.

Interest rates for housing loans in the philippines differ from bank to bank. As of 2nd january 2015 base lending rate blr has been updated to base rate br to reflect the recent changes made by bank negara malaysia and subsequently by major local banks the interest rate on a br 0 45 loan would be 4 45. And you can compare all their housing loan rates on this site. Effective financing rate for home financing i financing amount of rm350 000 above 30 years tenure no lock in period.

Compare the cheapest home loans from over 18 banks in malaysia. Here we zoom into the best rates for each of the different types of. Terms conditions apply. Shariah concept tawarruq minimum deposit rm 500 2 to 60 months minimum deposit rm 5 000 1 month members of the bank rakyat offered 0 1 higher than the benefits offered to the public.

For example if the current br rate is 4 00 update. For example for a 20 year period the interest of one housing loan is 5 50 1 year fixed term while for security bank it s 5 25. The published rates fees and charges are effective from 1st april 2019 following the implementation of 6 sst from 1st september 2018.